How much is car insurance for an 18-year-old?

The average cost of car insurance for an 18-year-old is $411 per month. This comes out to $4,931 per year, which is $3,279 more expensive than the average cost of coverage for adults (drivers ages 30, 35, and 45).

Even though rates for 18-year-olds are high, young drivers can still find affordable car insurance coverage by comparing rates from different companies. For example, rates for an 18-year-old at COUNTRY Financial are 49% cheaper than average for drivers this age at $209 per month.

Many companies with the lowest car insurance rates for 18-year-olds aren’t national carriers, including COUNTRY. But we found cheap coverage is also available with USAA, State Farm, and GEICO, which sell car insurance in almost every state.

Rank | Company | Monthly cost | Annual cost |

|---|---|---|---|

1 | COUNTRY Financial | $209 | $2,512 |

2 | Erie | $222 | $2,663 |

3 | USAA | $230 | $2,759 |

4 | State Farm | $252 | $3,022 |

5 | GEICO | $254 | $3,046 |

6 | Auto-Owners Insurance | $265 | $3,185 |

7 | American Family | $266 | $3,190 |

8 | MAPFRE | $267 | $3,199 |

9 | Farm Bureau | $269 | $3,222 |

10 | Kemper | $339 | $4,066 |

11 | Travelers | $341 | $4,087 |

12 | Shelter Insurance | $366 | $4,394 |

13 | Nationwide | $407 | $4,878 |

14 | The Hartford | $416 | $4,996 |

15 | Allstate | $455 | $5,465 |

Cost of full-coverage car insurance for 18-year-olds with their own policy.

Cheapest car insurance for 18-year-old drivers: COUNTRY

The cheapest car insurance company for 18-year-old drivers is COUNTRY. On average, COUNTRY costs 18-year-olds $2,419 less per year than the average rate for their age range — nearly half the national average cost.

COUNTRY is also the best insurance company for 18-year-old drivers thanks to its discounts. Besides multi-policy and legacy discounts, COUNTRY offers a few other cost-saving opportunities that are designed for young drivers, including:

Good student discount: As long as you maintain at least a B grade point average, you’ll save on car insurance. You can also get another discount if you graduate from college, too.

Driver training discount: Like other companies, COUNTRY offers discounts to 18-year-olds who complete a defensive driving course.

COUNTRY also receives very few complaints, according to the National Association of Insurance Commissioners. J.D. Power also recognized COUNTRY as one of the best companies for service in the Midwest in its 2021 Auto Insurance Study.

Best car insurance companies for 18-year-olds

Our experts rated the top insurance companies for 18-year-olds based price, customer service, convenience, and financial strength.

The best overall car insurance for 18-year-olds is GEICO, which has the highest Policygenius rating of any of the cheapest companies.

Company | Policygenius rating | J.D. Power score (out of 1,000) | Complaints index (lower is better) | Tech score (out of five) |

|---|---|---|---|---|

GEICO | 4.6 | 881 | 0.73 | 4.8 |

COUNTRY Financial | 4.3 | Not rated | 0.14 | 4.1 |

Travelers | 4.3 | 871 | 0.93 | 4.7 |

American Family | 4.2 | 889 | 0.22 | 4.8 |

Farm Bureau | 4.2 | Not rated | 0.08 | 3 |

USAA | 4.0 | 909 | 1.24 | 4.8 |

Shelter | 4.0 | Not rated | 0.39 | 3.7 |

Allstate | 4.0 | 870 | 0.63 | 4.8 |

Erie | 3.9 | 901 | 1.69 | 3 |

Auto-Owners | 3.9 | Not rated | 0.7 | 3.1 |

MAPFRE | 3.9 | Not rated | 0.29 | 1.7 |

State Farm | 3.8 | 892 | 0.71 | 4.8 |

Nationwide | 3.8 | 876 | 0.44 | 4.4 |

The Hartford | 3.7 | 905 | 1.7 | 3.9 |

Kemper | 3.4 | 798 | 3.11 | 1.9 |

Ratings for the top 15 cheapest companies for 18-year-old car insurance.

Cheap car insurance for 18-year-olds in every state

GEICO has the cheapest average car insurance rates for 18-year-olds in 13 states. Behind GEICO, USAA is the cheapest company in 12 states. And COUNTRY is the absolute cheapest company for 18-year-olds in Illinois and Oregon.

Depending on where you live, the cheapest available rates for 18-year-olds range from $74 to $321 per month.

State | Cheapest company | Monthly cost |

|---|---|---|

GEICO | $173 | |

USAA | $189 | |

GEICO | $153 | |

USAA | $213 | |

Wawanesa | $161 | |

American National | $148 | |

GEICO | $233 | |

USAA | $252 | |

Erie | $224 | |

GEICO | $321 | |

Auto-Owners Insurance | $205 | |

GEICO | $74 | |

American National | $102 | |

COUNTRY Financial | $164 | |

USAA | $120 | |

State Farm | $149 | |

American Family | $221 | |

GEICO | $237 | |

USAA | $257 | |

Auto-Owners Insurance | $130 | |

USAA | $193 | |

USAA | $210 | |

GEICO | $196 | |

Farm Bureau | $173 | |

USAA | $167 | |

USAA | $136 | |

State Farm | $206 | |

Farmers Mutual of Nebraska | $197 | |

GEICO | $207 | |

Auto-Owners Insurance | $138 | |

GEICO | $196 | |

USAA | $169 | |

American Family | $198 | |

State Farm | $130 | |

American Family | $196 | |

USAA | $137 | |

American Farmers and Ranchers | $168 | |

COUNTRY Financial | $146 | |

GEICO | $207 | |

State Farm | $218 | |

American National | $139 | |

Kemper | $193 | |

GEICO | $169 | |

Farm Bureau | $146 | |

GEICO | $193 | |

Auto-Owners Insurance | $145 | |

GEICO | $169 | |

PEMCO | $250 | |

State Farm | $184 | |

USAA | $135 | |

American National | $201 |

Cost of full-coverage car insurance for 18-year-olds with their own policy.

Average cost of car insurance for 18-year-olds in every state

Hawaii has the cheapest car insurance for 18-year-olds of any state, because it doesn’t allow insurance companies to set rates by age.

Louisiana is the most expensive state for 18-year-old drivers, car insurance costs 18-year-olds an average of $748 per month in the Pelican State.

State | Monthly cost | Annual cost |

|---|---|---|

Alabama | $497 | $5,964 |

Alaska | $319 | $3,825 |

Arizona | $411 | $4,934 |

Arkansas | $438 | $5,255 |

California | $384 | $4,606 |

Colorado | $422 | $5,059 |

Connecticut | $511 | $6,137 |

Delaware | $577 | $6,923 |

District of Columbia | $501 | $6,011 |

Florida | $697 | $8,368 |

Georgia | $460 | $5,524 |

Hawaii | $110 | $1,325 |

Idaho | $307 | $3,686 |

Illinois | $352 | $4,226 |

Indiana | $263 | $3,160 |

Iowa | $238 | $2,858 |

Kansas | $372 | $4,461 |

Kentucky | $521 | $6,254 |

Louisiana | $748 | $8,981 |

Maine | $293 | $3,517 |

Maryland | $470 | $5,635 |

Massachusetts | $483 | $5,794 |

Michigan | $567 | $6,804 |

Minnesota | $285 | $3,416 |

MIssissippi | $413 | $4,961 |

Missouri | $364 | $4,363 |

Montana | $486 | $5,827 |

Nebraska | $360 | $4,325 |

Nevada | $552 | $6,619 |

New Hampshire | $330 | $3,955 |

New Jersey | $629 | $7,542 |

New Mexico | $354 | $4,250 |

New York | $481 | $5,777 |

North Carolina | $187 | $2,246 |

North Dakota | $344 | $4,126 |

Ohio | $271 | $3,247 |

Oklahoma | $485 | $5,825 |

Oregon | $367 | $4,401 |

Pennsylvania | $417 | $5,000 |

Rhode Island | $564 | $6,773 |

South Carolina | $429 | $5,151 |

South Dakota | $352 | $4,228 |

Tennessee | $367 | $4,401 |

Texas | $460 | $5,518 |

Utah | $419 | $5,030 |

Vermont | $286 | $3,432 |

Virginia | $348 | $4,175 |

Washington | $427 | $5,123 |

West Virginia | $423 | $5,076 |

Wisconsin | $296 | $3,551 |

Wyoming | $336 | $4,033 |

Average car insurance cost for 18-year-old male and female drivers

In most states, your rates are determined in part by the gender that’s on your license. Car insurance for 18-year-old male drivers is, on average, more expensive than it is for female drivers with the exact same profile.

On average, the cost for male drivers is $439 per month — $56 more than for their female counterparts.

Gender | Monthly cost | Annual cost |

|---|---|---|

Male driver | $439 | $5,268 |

Female driver | $383 | $4,594 |

Difference | $56 | $674 |

Costs for full-coverage car insurance.

The difference between the cost of car insurance for 18-year-old male and female drivers at the cheapest companies is the least at Farm Bureau-affiliated insurance groups. With Farm Bureau, male drivers pay just $4 more each month for coverage.

Company | Difference | Male drivers | Female drivers |

|---|---|---|---|

Farm Bureau | $4 | $250 | $246 |

COUNTRY Financial | $15 | $217 | $202 |

USAA | $17 | $238 | $222 |

GEICO | $23 | $265 | $243 |

American Family | $23 | $313 | $290 |

Kemper | $39 | $426 | $387 |

MAPFRE | $47 | $290 | $243 |

State Farm | $51 | $277 | $227 |

Erie | $51 | $247 | $196 |

Auto-Owners Insurance | $51 | $276 | $225 |

Annual cost of full-coverage for 18-year-olds. Companies listed are the ten cheapest for 18-year-old drivers.

How much is car insurance for an 18 year old compared to other ages?

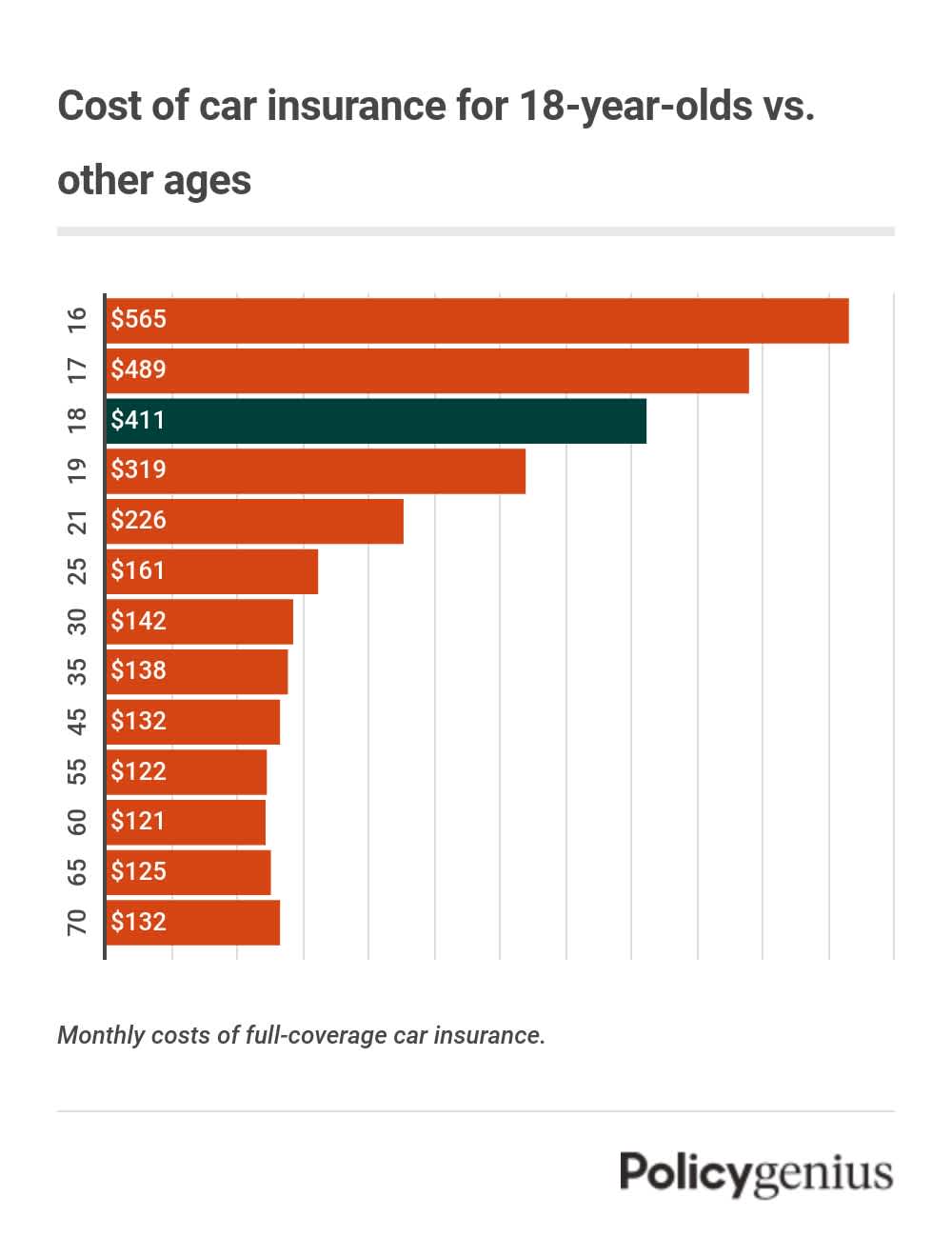

The cost of car insurance for 18-year-olds is cheaper than for 16-year-olds, but 18-year-olds pay an average of 198% more than 30, 35, and 45-year-olds.

Car insurance rates for 18-year-olds are much higher than for older drivers because they’re more likely to drive recklessly, get tickets, cause accidents, and file claims than more experienced drivers.

According to the Department of Transportation, 18-year-old drivers were behind the wheel for 9,500 fatal crashes from 2011 to 2020. This is why younger drivers pay more for coverage than older people. [1]

But as long as 18-year-olds keep their driving records clean, their rates will go down with age, and level out around 25, when they age out of the highest-risk age group.

Full-coverage car insurance, ordered by age.

Average insurance cost for 18-year-olds vs. other young drivers

The cost of insurance for 18-year-olds is higher than average, but it’s still cheaper than coverage for even younger drivers. Compared to 16-year-olds, insurance costs 18-year-olds $1,848 less per year. From 16 to 18 years old, car insurance costs drop by 37%.

But compared to drivers with slightly more experience behind the wheel, insurance for an 18-year-old is still significantly more expensive. Our analysis reveals that the average rates for a 21-year-old are $2,223 cheaper per year than for an 18-year-old — a difference of 45%.

Age | Monthly cost | Difference from 18-year-olds |

|---|---|---|

16 | $565 | 37% |

18 | $411 | -- |

21 | $226 | -45% |

25 | $161 | -61% |

Cost of full-coverage car insurance for 18-year-olds with their own policy.

→ Read more about how car insurance for young drivers gets cheaper over time

Can an 18-year-old get their own car insurance?

It’s legal for an 18-year-old to get their own car insurance policy. Unlike younger drivers who are legally minors, 18-year-olds can enter into an insurance agreement without a parent or guardian’s permission.

But if you have an 18-year-old driver in your household, it’s a better idea to add them to your existing policy than for them to get their own. Most companies require you to list all the licensed drivers on your policy anyways. Adding a young driver to your policy will raise your rates, but it will probably still be cheaper than if they got their own policy.

But 18-year-olds who no longer live at home and have their own car will need their own policy. One exception is if they are away at school — many companies offer discounts for families who have a college student who is away at school without a car.

How to get the cheapest car insurance for 18 year olds

Car insurance for 18-year-olds is expensive, but it’s still possible to find affordable coverage. You can avoid paying too much for insurance for teens by:

Not getting a separate policy: It’s expensive to add an 18-year-old to an existing policy, but it costs much more to get them a separate car insurance policy. Plus, if your 18-year-old has their own car, most insurers offer a discount for insuring more than one vehicle on the same policy.

Looking for discounts for teen drivers: Companies sometimes offer discounts for young drivers. These include discounts for good students, completing a new driver course, and away-from-home discounts for students.

Considering usage-based programs: Usage-based or telematics programs that monitor driving habits could lower insurance costs for 18-year-olds — as long as they’re safe drivers.

Making sure you don’t have too much insurance: While it’s a good idea to carry comprehensive and collision coverage, they may not be necessary for older cars. If your teen drives an old clunker that isn’t worth much, you can drop those coverages

Switching to per-mile insurance: Per-mile insurance plans may be cheaper than a standard policy for 18-year-old drivers who don’t use their cars often. Liberty Mutual, Allstate, and Nationwide all have pay-per-mile car insurance plans, but 18-year-olds will have to get their own per-mile plans.

If you’re still having trouble finding affordable car insurance for an 18-year-old, the most dependable way to ensure you’re getting the lowest rates is to shop around and compare quotes from more than one insurance company in your area.