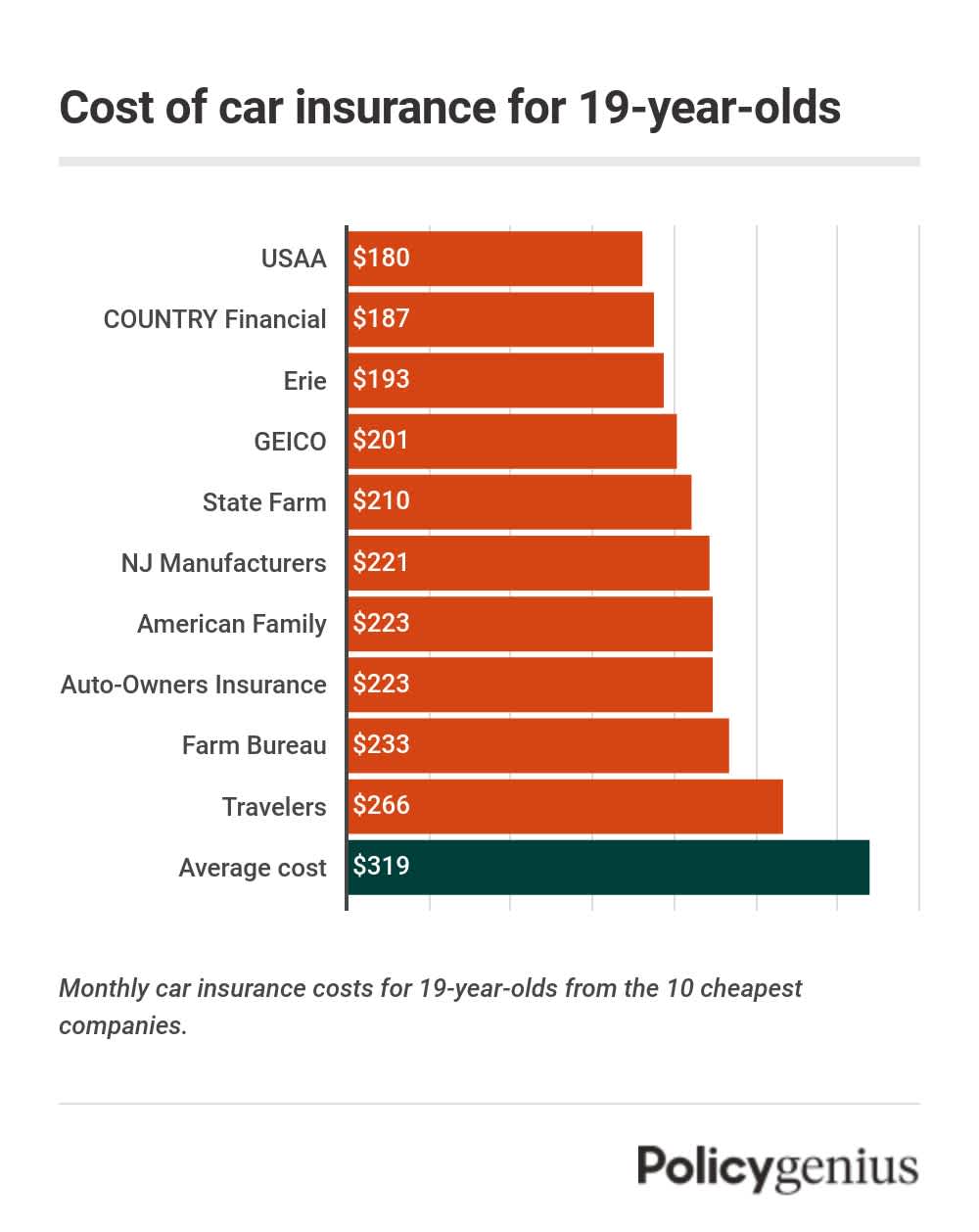

Car insurance costs 19-year-old drivers $319 per month on average (or $3,822 per year). Teens generally have the highest car insurance rates, and coverage for 19-year-olds is $2,170 more expensive per year than for typical drivers.

Rates are more expensive than average for 19-year-olds, but you can still get cheap auto insurance quotes with some companies. We found that car insurance for 19-year-olds is cheapest from COUNTRY, which offers coverage for 43% less than average for this age group.

How much is car insurance for 19-year-olds?

The average 19-year-old pays $319 each month for car insurance, or $3,822 per year. Compared to the average cost of coverage for most drivers, the cost of auto insurance for 19-year-olds is 131% more expensive.

Despite the high average cost of car insurance for 19-year-olds, many companies offer coverage at much more affordable rates. Our analysis found that the cost of insurance from the cheapest companies can be 30% lower than average.

USAA has the cheapest car insurance for 19-year-olds, but it’s only available to members of the military, veterans, and their families. COUNTRY is the cheapest provider for 19-year-olds that offers coverage to the general public.

The difference between the cheapest and most expensive companies for 19-year-olds can be thousands of dollars a year, which is why it’s so important for young drivers to shop around and compare rates before picking a policy.

Since rates can vary so much from company to company, even for the same exact driver, this is the best way to avoid paying more than you have to for car insurance.

Rank | Company | Average monthly cost | Average annual cost |

|---|---|---|---|

1 | USAA | $180 | $2,161 |

2 | COUNTRY Financial | $187 | $2,246 |

3 | $193 | $2,312 | |

4 | $201 | $2,415 | |

5 | $210 | $2,521 | |

6 | NJ Manufacturers | $221 | $2,655 |

7 | $223 | $2,671 | |

8 | Auto-Owners Insurance | $223 | $2,672 |

9 | Farm Bureau | $233 | $2,790 |

10 | $266 | $3,192 | |

11 | MAPFRE | $267 | $3,199 |

12 | Kemper | $285 | $3,420 |

13 | $304 | $3,648 | |

14 | Shelter Insurance | $316 | $3,795 |

15 | The Hartford | $350 | $4,195 |

16 | $350 | $4,203 | |

17 | National General | $370 | $4,440 |

18 | $396 | $4,751 | |

19 | CSAA | $415 | $4,985 |

20 | $434 | $5,211 | |

21 | $446 | $5,350 | |

22 | Auto Club Group | $447 | $5,366 |

23 | Sentry Insurance | $547 | $6,561 |

24 | Mercury Insurance | $619 | $7,433 |

25 | Hanover | $792 | $9,502 |

Table shows the cost of full-coverage car insurance.

Can a 19-year-old get their own car insurance?

Yes, unlike younger drivers, 19-year-olds can buy their own car insurance. Auto insurance policies are contracts between a driver and company, and only adults can agree to contracts.

Drivers who are younger than 19, like newly-licensed 16 and 17 year olds, can only get car insurance by joining a parent’s existing policy or by getting their permission first.

Average cost of car insurance for 19-year-old male and female drivers

Car insurance rates for 19-year-olds may vary depending on the driver’s gender. Rates are more expensive, on average, for men than for women. We found that the cost of car insurance for 19-year-old male drivers is $41 more per month than it is for female drivers.

Gender | Monthly cost | Annual cost |

|---|---|---|

Male driver | $339 | $4,068 |

Female driver | $298 | $3,571 |

Difference | $41 | $496 |

A handful of states don’t allow insurance companies to set costs based on gender. In the following states, male 19-year-old drivers won’t pay more than their female counterparts:

California

Hawaii

Massachusetts

Michigan

Pennsylvania

Does car insurance cost more for 19-year-old male or female drivers?

Car insurance costs more for 19-year-old male drivers than for female drivers of the same age, but the difference in costs depends in part on the company.

Of the companies with the lowest car insurance rates for 19-year-olds, the difference between what male and female drivers pay is least at GEICO. At GEICO male drivers pay only $15 more per month than female drivers.

Company | Male driver | Female driver | Difference |

|---|---|---|---|

GEICO | $209 | $194 | $15 |

USAA | $187 | $174 | $13 |

COUNTRY Financial | $193 | $181 | $12 |

NJ Manufacturers | $230 | $213 | $17 |

American Family | $255 | $238 | $17 |

Companies shown here are the 10 cheapest providers on average for 19-year-olds.

→ Read more about the differences in the cost of insurance for men and women

Cost of car insurance for 19-year-olds compared to other ages

The cost of car insurance for 19-year-olds is more expensive than average — but still cheaper than for younger drivers. We found that car insurance costs 19-year-olds 131% more than average, but 35% less than for drivers ages 16, 17, and 18.

Costs of a full-coverage car insurance policy.

Nineteen-year-olds pay higher average auto insurance premiums for 19-year-olds because they're more inexperienced than older drivers. Data shows that 19-year-olds are more likely to get into accidents than older drivers, which makes them more of a risk for companies to insure.

How much is car insurance for 19-year-olds in every state?

Across the country, the 19-year-olds pay an average of $3,822 per year for car insurance, but your rates depend in part on where you live. The cost of car insurance for 19-year-olds varies by as much as $5,739 when you compare the cheapest and most expensive states.

Hawaii has the cheapest car insurance for 19-year-olds of any state, because it doesn’t allow car insurance companies to consider age.

On the other hand, Louisiana, already one of the priciest states for coverage, has the most expensive car insurance for 19-year-olds at $7,001 per year.

State | Average monthly cost | Average annual cost |

|---|---|---|

$366 | $4,397 | |

$252 | $3,020 | |

$318 | $3,812 | |

$337 | $4,048 | |

$308 | $3,699 | |

$325 | $3,906 | |

$389 | $4,670 | |

$426 | $5,112 | |

$374 | $4,490 | |

$524 | $6,290 | |

$351 | $4,213 | |

$105 | $1,263 | |

$234 | $2,813 | |

$278 | $3,342 | |

$213 | $2,558 | |

$193 | $2,320 | |

$290 | $3,477 | |

$412 | $4,941 | |

$583 | $7,001 | |

$232 | $2,787 | |

$372 | $4,469 | |

$373 | $4,477 | |

$448 | $5,374 | |

$236 | $2,833 | |

$320 | $3,843 | |

$294 | $3,526 | |

$374 | $4,493 | |

$288 | $3,460 | |

$420 | $5,038 | |

$262 | $3,148 | |

$472 | $5,662 | |

$276 | $3,311 | |

$379 | $4,547 | |

$142 | $1,702 | |

$264 | $3,163 | |

$208 | $2,498 | |

$371 | $4,450 | |

$281 | $3,374 | |

$326 | $3,917 | |

$422 | $5,067 | |

$337 | $4,044 | |

$277 | $3,319 | |

$278 | $3,331 | |

$358 | $4,302 | |

$316 | $3,798 | |

$224 | $2,684 | |

$268 | $3,221 | |

$326 | $3,913 | |

$332 | $3,987 | |

$219 | $2,623 | |

$268 | $3,221 |

On average, car insurance for 19-year-old drivers costs $187 per month (or $2,246 per year) with COUNTRY Financial. This makes COUNTRY 41% cheaper than average for 19-year-olds.

In addition to cheap rates, COUNTRY also offers 19-year-olds a few insurance discounts that they can use to lower costs. These include discounts for full-time students who keep up a B average or better, and discounts for completing a defensive course.

COUNTRY also offers endorsements like new car replacement for vehicles up to five years old (better than the typical three-year limit). You can also add roadside assistance and personal effects coverage, though these are more typical offerings.

Cheapest car insurance for 19-year-olds in every state

Although COUNTRY is the cheapest car insurance for 19-year-olds, it’s actually not the cheapest company in any single state. USAA is the cheapest car insurance company for 19-year-olds in 18 states.

Behind USAA, GEICO has the lowest car insurance rates for 19-year-old drivers in 14 states.

State | Cheapest company | Average monthly cost | Average annual cost |

|---|---|---|---|

Alabama | GEICO | $146 | $1,758 |

Alaska | USAA | $151 | $1,807 |

Arizona | GEICO | $129 | $1,547 |

Arkansas | USAA | $161 | $1,931 |

California | Wawanesa | $140 | $1,680 |

Colorado | American National | $130 | $1,556 |

Connecticut | GEICO | $177 | $2,130 |

Delaware | USAA | $202 | $2,421 |

District of Columbia | USAA | $189 | $2,268 |

Florida | GEICO | $264 | $3,168 |

Georgia | USAA | $170 | $2,040 |

Hawaii | GEICO | $70 | $838 |

Idaho | American National | $88 | $1,055 |

Illinois | Pekin | $134 | $1,604 |

Indiana | USAA | $105 | $1,256 |

Iowa | State Farm | $125 | $1,498 |

Kansas | USAA | $169 | $2,023 |

Kentucky | GEICO | $191 | $2,297 |

Louisiana | USAA | $221 | $2,654 |

Maine | Auto-Owners Insurance | $111 | $1,338 |

Maryland | USAA | $144 | $1,729 |

Massachusetts | USAA | $170 | $2,036 |

Michigan | GEICO | $160 | $1,924 |

Minnesota | Farm Bureau | $149 | $1,783 |

Mississippi | USAA | $135 | $1,616 |

Missouri | USAA | $112 | $1,343 |

Montana | USAA | $162 | $1,943 |

Nebraska | Farmers Mutual Insurance Co. of Nebraska | $176 | $2,113 |

Nevada | GEICO | $162 | $1,949 |

New Hampshire | Auto-Owners Insurance | $121 | $1,448 |

New Jersey | GEICO | $171 | $2,057 |

New Mexico | USAA | $137 | $1,647 |

New York | American Family | $167 | $2,004 |

North Carolina | GEICO | $95 | $1,137 |

North Dakota | USAA | $153 | $1,830 |

Ohio | USAA | $117 | $1,404 |

Oklahoma | American Farmers and Ranchers | $152 | $1,821 |

Oregon | COUNTRY Financial | $130 | $1,564 |

Pennsylvania | GEICO | $172 | $2,062 |

Rhode Island | State Farm | $184 | $2,210 |

South Carolina | American National | $114 | $1,367 |

South Dakota | Kemper | $175 | $2,102 |

Tennessee | GEICO | $139 | $1,674 |

Texas | Farm Bureau | $134 | $1,608 |

Utah | GEICO | $147 | $1,761 |

Vermont | Auto-Owners Insurance | $127 | $1,527 |

Virginia | GEICO | $139 | $1,663 |

Washington | PEMCO | $211 | $2,536 |

West Virginia | USAA | $164 | $1,972 |

Wisconsin | USAA | $109 | $1,309 |

Wyoming | American National | $161 | $1,929 |

Monthly and annual costs of full-coverage car insurance across every state.

How to get cheap car insurance at 19

Car insurance for 19-year-olds can be expensive, but you can still get cheap rates with a little extra work.

The most reliable way 19-year-olds can find the best auto insurance is by comparing quotes from multiple companies and picking the one that offers the most affordable rates Other ways to save on car insurance for teens include:

Staying on a shared policy: Adding a 19-year-old to an existing policy is almost always cheaper than getting a separate policy. As long as you live at home, joining your parents’ insurance is a great way to lower your costs.

Maintaining high grades: Most insurance companies offer discounts to high school and college students who keep their grades high. If you can get and keep a B average or better, your rates will be lower.

Signing up for usage-based insurance: Most companies offer discounts through a telematics program. When you sign up, your driving will be monitored for a few weeks. If you’re a safe driver, you could earn significant discounts.