What is DUI insurance?

There’s actually no such thing a DUI insurance. If you have a DUI on your record, you still need a normal car insurance policy, not a special type of car insurance.

But car insurance after a DUI will cost more than it would if you had a clean driving record, and you may be considered a high-risk driver or need to get car insurance from a company known for non-standard car insurance.

This is true for drivers who get a DWI, OWI, OUI, or OWVI instead of a DUI — your car insurance rates will be a lot higher in the years following the violation, but there’s no special type of car insurance specifically for a DWI, OUI, or any other offense.

→ Read about the difference between a DUI and other similar violations

DUI insurance vs. SR-22 insurance

Many states require drivers with a DUI to get an SR-22, which is a form that your car insurance company files with your state proving that you have car insurance.

You’ll have to pay a fee when your insurance company files your SR-22. These fees are usually small (about $25), but you’ll have to renew your policy with the SR-22 and pay the fee again for however many years it's required.

Florida and Virginia sometimes require a form called an FR-44 as proof of insurance after a DUI. An FR-44 works the same way as an SR-22, but it requires you to have more car insurance than with an SR-22.

Cheapest DUI car insurance by company

We found that State Farm has the cheapest car insurance rates after a DUI. On average, State Farm costs $132 per month or $1,588 a year after a DUI.

Smaller companies like NJM, MAPFRE, and Erie also have cheap DUI insurance, but aren’t available in every state. It’s a good idea to compare rates to look for the cheapest coverage in your area.

Company name | Average yearly cost with DUI | Average yearly cost with clean record | Increase after DUI |

|---|---|---|---|

State Farm | $1,588 | $1,141 | +$447 |

NJM | $1,620 | $1,262 | +$358 |

MAPFRE | $2,047 | $1,040 | +$1,007 |

Erie | $2,082 | $1,181 | +$901 |

USAA* | $2,110 | $1,044 | +$1,066 |

Travelers | $2,122 | $1,351 | +$771 |

American Family | $2,149 | $1,479 | +$670 |

Farm Bureau | $2,156 | $1,547 | +$609 |

Progressive | $2,318 | $1,780 | +$538 |

COUNTRY Financial | $2,355 | $1,416 | +$939 |

USAA is only available to veterans, members of the military, and their families.

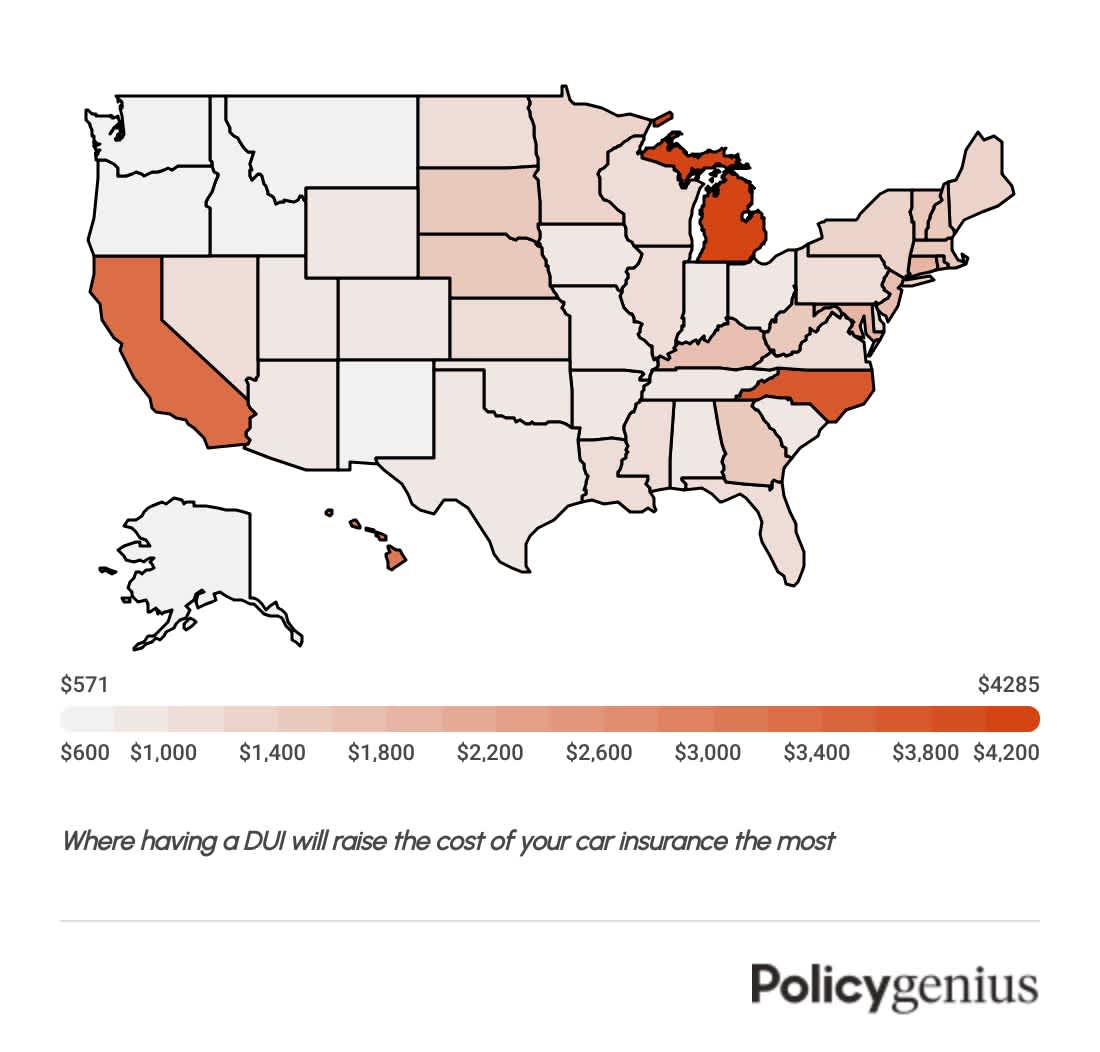

Cheapest DUI car insurance rates by state

The cheapest company depends on where you live and the details of your record, but we found that State Farm has the cheapest car insurance for people with a DUI in most states.

American National, GEICO, National General, NJM, Progressive, USAA, and Wawanesa are each the cheapest company for DUI insurance in some states.

State | Average monthly cost | Cheapest company |

|---|---|---|

$116 | State Farm | |

$89 | State Farm | |

$109 | State Farm | |

$88 | State Farm | |

$146 | Wawanesa | |

$109 | American National | |

$107 | State Farm | |

$107 | State Farm | |

$134 | State Farm | |

$146 | State Farm | |

$123 | State Farm | |

$89 | State Farm | |

$52 | State Farm | |

$87 | State Farm | |

$84 | State Farm | |

$64 | State Farm | |

$99 | State Farm | |

$170 | State Farm | |

$149 | State Farm | |

$68 | State Farm | |

$99 | GEICO | |

$152 | GEICO | |

$151 | Progressive | |

$88 | State Farm | |

$98 | State Farm | |

$100 | State Farm | |

$92 | State Farm | |

$138 | State Farm | |

$106 | State Farm | |

$98 | USAA | |

$135 | NJM | |

$86 | State Farm | |

$99 | Progressive | |

$236 | National General | |

$84 | State Farm | |

$67 | State Farm | |

$93 | State Farm | |

$77 | State Farm | |

$88 | State Farm | |

$80 | State Farm | |

$89 | American National | |

$100 | State Farm | |

$78 | State Farm | |

$113 | Redpoint | |

$112 | State Farm | |

$58 | State Farm | |

$77 | State Farm | |

$103 | State Farm | |

$92 | State Farm | |

$75 | State Farm | |

$112 | State Farm |

Average monthly DUI insurance costs for full-coverage.

How does a DUI affect your car insurance?

Your car insurance rates will go up after a DUI. On average, DUI insurance costs $248 per month or $2,977 a year — that’s $1,339 more expensive than car insurance without a DUI.

It’s also harder to get car insurance with a DUI. Many companies opt not to cover high-risk drivers because they’re more likely to make a future claim.

Also, your insurance company may drop you right away or may refuse to renew your policy if you have a DUI.

How long does a DUI stay on your driving record?

Every state has different rules about how long a DUI stays on your driving record. If you live somewhere that uses a points system, the points on your license from the DUI may come off after two to five years while the DUI may stay on your record permanently.

But that doesn’t mean you’ll always pay more for insurance with a DUI on your record. Your rates will be higher than average for a while, but they’ll return to average eventually, as long as you don’t commit any more violations or get any tickets.

Can you get away with not telling insurance about DUI?

In short, no. If you already have a DUI on your record, be sure to disclose it when you’re applying for car insurance. Companies will see a DUI when they check your motor vehicle report (MVR) anyways, so being upfront about it from the beginning will just mean that you’ll get more accurate quotes.

You should also notify your current car insurance company when you get a DUI. It’s usually not a rule that you have to tell your car insurance company about a new DUI, but it’s better to be honest about it and avoid the risk of violating your policy.

Telling your insurance company about a DUI may also help you better prepare for a rate increase once it's time to renew your policy.

I crashed my car and got a DUI — am I covered?

Your car insurance company may cover the damage if you cause an accident while drinking and driving, but it depends on your state and the company. If you’re not sure how your coverage applies to a drunk driving accident, it may be time to speak to a lawyer or legal expert.

Even if you’re covered for an accident that you caused while under the influence, your car insurance company will probably drop your coverage after paying out any damage.

It won’t be cheap to get a new car insurance policy after an accident. You may now have a DUI and an at-fault accident on your record, so your rates will be even higher than someone with only one violation.

You may even have to find coverage from a non-standard company (like The General, Oxford, or Freeway Insurance) or through your state’s assigned-risk insurance pool, which promises coverage to high-risk drivers who can’t get coverage on the regular market.

How to shop for car insurance after a DUI

Unfortunately, there’s no insurance trick for avoiding the increase after a DUI. But there are a few steps that you can take to make finding DUI insurance easier — and cheaper.