What are the cheapest full-coverage car insurance companies?

We found that the cheapest full-coverage car insurance company is MAPFRE. On average, full coverage from MAPFRE costs just $87 a month, or $1,040 per year — 37% cheaper than the national average of $1,638 per year.

MAPFRE only offers car insurance in 18 states, so if you can get it in your area, USAA (if you’re a part of a military family) and State Farm are other options for cheap full-coverage insurance.

Company name | Average monthly rate | Average annual rate | Difference from average |

|---|---|---|---|

$87 | $1,040 | -37% | |

$87 | $1,044 | -36% | |

$95 | $1,141 | -30% | |

$97 | $1,165 | -29% | |

$98 | $1,181 | -28% | |

$99 | $1,192 | -27% | |

$105 | $1,262 | -23% | |

$113 | $1,351 | -18% | |

$118 | $1,416 | -14% | |

$123 | $1,475 | -10% |

USAA is only available to active and retired members of the military and their families

Full-coverage car insurance means a car insurance policy with comprehensive and collision coverage, plus the liability coverage that’s required in almost every state. A full coverage policy covers damage to your own car, whether it’s from a crash, a storm, an animal, or if it’s stolen or vandalized.

Cheapest full-coverage car insurance by driver

The auto insurance company with the cheapest full coverage for most people may not be the cheapest company for you. That’s because what you pay for car insurance depends on personal details like your driving record, location, and even credit score.

To be sure you’re getting the cheapest rates for full coverage, we recommend comparing quotes from a few companies before buying a policy.

Cheapest full coverage for teens: Farm Bureau

The cheapest full-coverage car insurance for families with teens is Farm Bureau. A full-coverage Farm Bureau policy that includes a teen driver is $168 a month on average, or $2,012 per year.

That’s $1,315 cheaper than the national average for a full-coverage policy that includes a teenage driver ($3,327 per year).

Company | Average monthly rate | Average annual rate |

|---|---|---|

USAA* | $165 | $1,983 |

Farm Bureau | $168 | $2,012 |

NJM | $169 | $2,022 |

GEICO | $179 | $2,147 |

MAPFRE | $202 | $2,420 |

Table shows average rates for families with a teen driver (16 to 19 years old). USAA is only available to active and retired members of the military and their families.

Cheapest full coverage for seniors: State Farm

The cheapest full-coverage car insurance company for seniors comes from State Farm. Car insurance rates get higher as drivers age, but at State Farm the cost of a full-coverage policy for a senior-aged driver is $87 a month, or $1,050 per year.

That means that State Farm’s full-coverage car insurance for seniors is $451 cheaper than average.

Company | Average monthly rate | Average annual rate |

|---|---|---|

USAA* | $81 | $974 |

State Farm | $87 | $1,050 |

Erie | $92 | $1,104 |

Auto-Owners | $92 | $1,108 |

GEICO | $94 | $1,123 |

Table shows average rates for senior drivers (ages 60 to 75 years old) USAA is only available to active and retired members of the military and their families.

Cheapest full coverage after an accident: State Farm

The cheapest full-coverage car insurance for a driver with an accident on their record is State Farm. On average, full coverage from State Farm costs $116 a month or $1,196 per year after a single at-fault accident.

That makes State Farm $1,140 cheaper than average after an accident.

Company | Average monthly rate after an at-fault accident | Average annual rate after an at-fault accident |

|---|---|---|

State Farm | $116 | $1,398 |

USAA* | $129 | $1,549 |

Erie | $138 | $1,651 |

Auto-Owners | $145 | $1,738 |

Travelers | $159 | $1,907 |

USAA is only available to active and retired members of the military and their families.

Cheapest full coverage with a DUI: State Farm

The cheapest full-coverage car insurance for drivers with a DUI comes from State Farm. On average, a full coverage car insurance policy with State Farm costs $132 a month or $1,588 per year for drivers with a single DUI.

A full-coverage policy from State Farm after a DUI is $1,372 cheaper than average.

Company | Average monthly rate after a DUI | Average annual rate after a DUI |

|---|---|---|

State Farm | $132 | $1,588 |

Erie | $173 | $2,082 |

USAA* | $176 | $2,110 |

Travelers | $177 | $2,122 |

American Family | $179 | $2,149 |

USAA is only available to active and retired members of the military and their families.

Cheapest full coverage with a speeding ticket: State Farm

The cheapest full-coverage car insurance company for drivers with a speeding ticket is State Farm. We found that full coverage from State Farm costs an average of $110 a month or $1,321 per year after a speeding ticket.

That’s $865 cheaper than the national average rate for drivers with a speeding ticket on their records.

Company | Average monthly rate after a speeding ticket | Average annual rate after a speeding ticket |

|---|---|---|

State Farm | $110 | $1,321 |

USAA* | $112 | $1,338 |

Erie | $118 | $1,412 |

Auto-Owners | $148 | $1,775 |

Farm Bureau | $161 | $1,934 |

USAA is only available to active and retired members of the military and their families.

Cheapest full coverage with bad credit: MAPFRE

The cheapest full-coverage car insurance for drivers with bad credit is MAPFRE. On average, a full-coverage auto policy from MAPFRE for someone with bad credit costs $125 a month or $1,504 per year.

In most states having bad credit raises the cost of car insurance (sometimes by a lot), but full coverage from MAPFRE costs $1,613 less than average for drivers with bad credit.

Company | Average monthly rate with bad credit | Average annual rate with bad credit |

|---|---|---|

MAPFRE | $125 | $1,504 |

GEICO | $157 | $1,885 |

USAA* | $170 | $2,042 |

NJM | $176 | $2,117 |

Nationwide | $181 | $2,166 |

USAA is only available to active and retired members of the military and their families.

Best cheap full-coverage auto insurance companies

Full-coverage car insurance is more expensive than a minimum-coverage policy. But that doesn’t mean it’s impossible to find affordable full coverage from a reputable company. Here are the best car insurance companies with cheap rates for full coverage.

Company | Policygenius rating | Average monthly rate | Average annual rate |

|---|---|---|---|

USAA | 5.0 | $87 | $1,044 |

Erie | 4.9 | $98 | $1,181 |

GEICO | 4.8 | $99 | $1,192 |

State Farm | 4.8 | $95 | $1,141 |

Amica | 4.7 | $131 | $1,574 |

Auto-Owners Insurance | 4.7 | $97 | $1,165 |

Country Financial | 4.7 | $118 | $1,416 |

NJM | 4.7 | $105 | $1,262 |

Travelers | 4.7 | $113 | $1,351 |

Acuity | 4.6 | $127 | $1,526 |

MAPFRE Insurance | 4.6 | $87 | $1,040 |

American National | 4.4 | $57 | $689 |

American Family | 4.3 | $123 | $1,479 |

Nationwide | 4.3 | $123 | $1,475 |

Safeco | 4.2 | $117 | $1,405 |

Germania | 4.1 | $112 | $1,341 |

Wawanesa | 3.8 | $80 | $959 |

Root | 3.1 | $76 | $916 |

Companies sorted from highest to lowest Policygenius rating.

Companies with cheap full-coverage auto insurance

Full-coverage auto insurance is more expensive than a minimum-coverage policy, but there are still plenty of companies that offer affordable full coverage. Here are the 15 cheapest companies for full-coverage:

Company name | Pg rating | Monthly cost | Annual cost |

|---|---|---|---|

MAPFRE | 4.1/5 ★ | $87 | $1,040 |

USAA* | 5.0/5 ★ | $87 | $1,044 |

State Farm | 4.8/5 ★ | $95 | $1,141 |

Auto-Owners Insurance | 4.7/5 ★ | $97 | $1,165 |

Erie | 4.9/5 ★ | $98 | $1,181 |

4.7/5 ★ | $99 | $1,192 | |

NJM | 4.7/5 ★ | $105 | $1,262 |

Travelers | 4.7/5 ★ | $113 | $1,351 |

COUNTRY Financial | 4.7/5 ★ | $118 | $1,416 |

4.3/5 ★ | $123 | $1,475 | |

4.3/5 ★ | $123 | $1,479 | |

Farm Bureau | 4.2/5 ★ | $129 | $1,547 |

4.7/5 ★ | $131 | $1,574 | |

Shelter | 4.0/5 ★ | $147 | $1,764 |

4.4/5 ★ | $148 | $1,780 | |

Kemper | 3.4/5 ★ | $149 | $1,783 |

USAA is only available to members of the military, veterans, and their families.

Since quotes for full-coverage can range from $87 to hundreds of dollars more per month, it’s important to compare quotes from top companies to find the cheapest coverage for you.

The cheapest full-coverage car insurance in every state

Since the cost of full-coverage can vary widely by location as well as by company, it’s worth comparing rates in your state before finalizing your policy.

Here’s the cheapest option for full-coverage car insurance by state:

State | Company | Average monthly cost |

|---|---|---|

Travelers | $83 | |

GEICO | $77 | |

Auto-Owners | $76 | |

State Farm | $80 | |

Wawanesa | $80 | |

American National | $70 | |

GEICO | $68 | |

State Farm | $97 | |

GEICO | $85 | |

State Farm | $134 | |

Auto-Owners | $88 | |

GEICO | $65 | |

American National | $41 | |

Pekin | $56 | |

State Farm | $59 | |

State Farm | $59 | |

GEICO | $76 | |

GEICO | $97 | |

State Farm | $124 | |

Auto-Owners | $51 | |

GEICO | $67 | |

GEICO | $85 | |

GEICO | $89 | |

State Farm | $80 | |

National General | $75 | |

State Farm | $62 | |

State Farm | $71 | |

Auto-Owners | $86 | |

GEICO | $96 | |

State Farm | $56 | |

GEICO | $84 | |

State Farm | $72 | |

Kemper | $79 | |

Erie | $62 | |

State Farm | $64 | |

State Farm | $59 | |

State Farm | $79 | |

State Farm | $71 | |

State Farm | $81 | |

State Farm | $79 | |

American National | $57 | |

State Farm | $93 | |

State Farm | $68 | |

Farm Bureau | $87 | |

GEICO | $82 | |

State Farm | $52 | |

State Farm | $70 | |

PEMCO | $76 | |

State Farm | $72 | |

GEICO | $57 | |

American National | $62 |

Monthly costs of full-coverage car insurance.

→ Read more about how the cost of insurance changes depending on the driver

What is full-coverage car insurance?

Full-coverage car insurance includes comprehensive and collision coverage in addition to liability coverage. Full coverage car insurance basically means damage to your own car is covered, in addition to damage you cause to others in an accident.

Full-coverage means your car insurance will cover the cost if your car is damaged by:

An at-fault accident, meaning a collision you cause

Animals, like if you hit a deer or rodents chew your car’s wiring

Falling objects, like if a tree branch smashes your window

Extreme weather, like hail or snow

Vandalism, like if someone keys your car

Theft, whether your vehicle itself is stolen or someone just steals a part, like your catalytic converter

Fire

Water and flooding

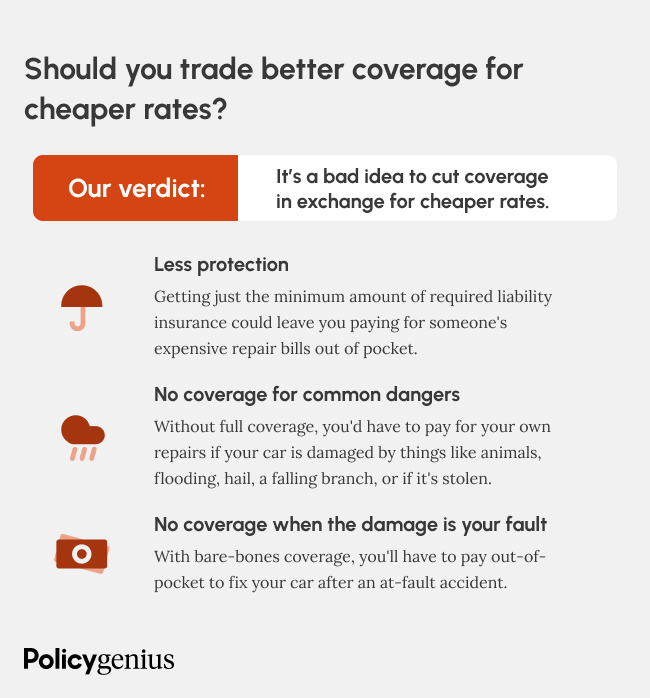

A liability-only car insurance policy only covers the damage that you do to other people’s cars, not to your own. If you don’t have full-coverage and you’re at-fault in an accident, you’d be stuck paying for your own repairs out of pocket.

How much is full-coverage compared to liability-only?

Full-coverage can be hundreds of dollars more expensive a year than liability-only insurance coverage. That’s because you’re adding more coverage to protect yourself from a wider range of damage. When companies cover more risks, they raise rates.

The extra cost of full-coverage can be well worth it if your car is totaled. According to data from the National Association of Insurance Commissioners, the comprehensive and collision parts of a full-coverage policy cost $518 per year.

Coverage type | Average monthly cost | Average annual cost |

|---|---|---|

Comprehensive | $13 | $160 |

Collision | $30 | $358 |

Liability | $50 | $605 |

USAA is only available to members of the military, veterans, and their families.

Your rates also depend on how much liability coverage you have. Having a policy with only enough coverage to drive legally is always going to be the cheapest option, but it may leave you seriously underprepared for an accident.

Here’s how much a policy with just the required liability coverage costs compared to full-coverage with two different amounts of liability:

Coverage level | Monthly cost | Annual cost |

|---|---|---|

Minimum coverage | $52 | $620 |

Full-coverage (50/100) | $138 | $1,638 |

Full-coverage (100/300) | $152 | $1,827 |

Who needs full-coverage car insurance?

Unlike other types of insurance, full-coverage car insurance is never required by law. But you’ll need full-coverage car insurance if:

→ Read about the amount of car insurance that you might need

What’s not covered by full-coverage car insurance?

Full-coverage is the best protection you can get, but there are some things that even a full-coverage policy won’t cover. These are things that just aren’t typically covered by car insurance, like:

Intentional damage, like if you set your car on fire

Normal wear and tear

General maintenance, like oil changes or new brake pads

Personal belongings that are stolen from your car, like a phone or laptop

Damage that exceeds your policy’s limits

Any damage that violates the terms of your policy, like damage that happened while racing illegally

How to get cheap full-coverage car insurance

The best way to be sure that you find your cheapest rates for full-coverage is by shopping around and getting quotes from multiple companies. While you shop, look for:

The companies with the lowest rates: Some carriers are better than others at offering cheap full-coverage to different types of drivers. Compare rates so you can tell which companies offer the best deal for your needs.

What “full-coverage” means at each company: Some companies offer extra perks to drivers who get a full-coverage policy, like accident forgiveness or trip interruption expense coverage. Be mindful of what you’ll get from each company so you can get the most coverage for your dollar.

Once you find a company that offers cheap full-coverage insurance, there’s still more that you can do to get lower rates, like:

Enrolling in a defensive driving course: Most insurance companies offer a discount if you’ve completed a defensive driving course in the last few years. Be sure to let your company know.

Switching to usage-based car insurance: Usage-based car insurance sets your rates based, in part, on how well (or how much) you drive. Lots of companies offer usage-based discount programs as a way to save.

Bundling home and auto policies: Nearly every company offers cheaper full-coverage if you bundle your home and auto policies together.

Reshopping and switching carriers: You can switch companies if yours isn�’t offering you the cheapest rates for full-coverage. It’s a good idea to shop around before your renewal date to be sure you’re getting the best deal.