The best car insurance company for 30-year-olds is GEICO. On average, 30-year-old drivers pay $142 per month, or $1,706 per year for coverage. GEICO is 30% cheaper than average — plus it’s available in every state.

Car insurance coverage costs slightly more for 30-year-old male drivers than for female drivers of the same age. But rates can also vary significantly from state to state, and even ZIP code to ZIP code.

How much is car insurance for a 30-year-old?

The average cost of car insurance for a 30-year-old driver is $142 per month. This comes out to $1,706 a year, about equal to the overall average rates for adult drivers in the U.S.

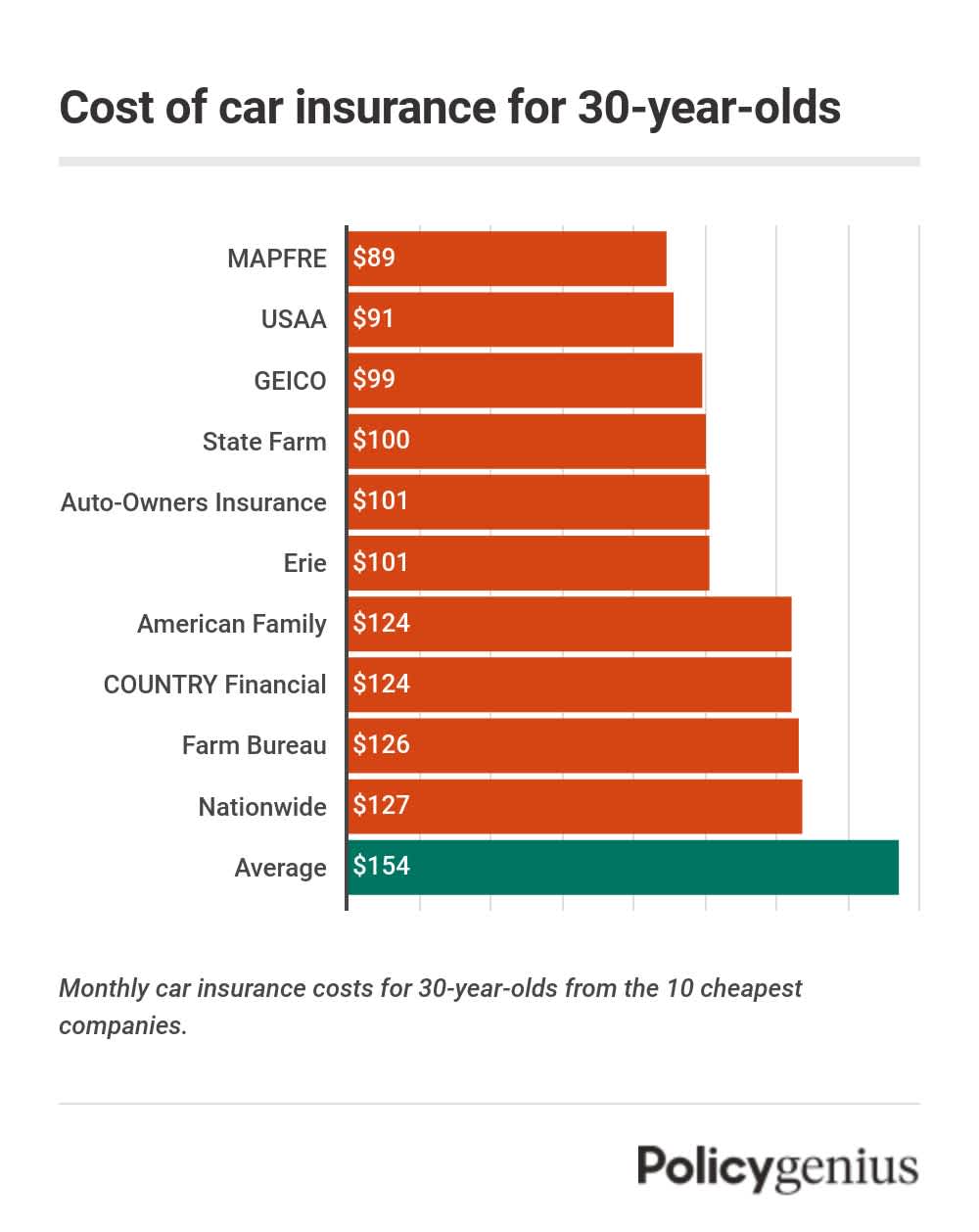

GEICO has the cheapest car insurance for 30-year-olds, with average rates that are $640 cheaper per year than average for the age group. A full-coverage policy from GEICO costs 30-year-olds $99 per month, or $1,188 each year.

While MAPFRE and USAA offer cheaper average rates for 30-year-olds than GEICO, they aren’t available to every driver. Unlike GEICO, MAPFRE only offers car insurance in a handful states while USAA only covers people in the military and their families.

Company | Average monthly cost | Average annual cost |

|---|---|---|

MAPFRE | $89 | $1,066 |

USAA | $91 | $1,091 |

GEICO | $99 | $1,188 |

State Farm | $100 | $1,194 |

Auto-Owners Insurance | $101 | $1,208 |

Erie | $101 | $1,212 |

American Family | $124 | $1,486 |

COUNTRY Financial | $124 | $1,488 |

Farm Bureau | $126 | $1,513 |

Nationwide | $127 | $1,520 |

NJ Manufacturers | $128 | $1,539 |

Travelers | $130 | $1,564 |

Kemper | $141 | $1,694 |

Amica | $145 | $1,735 |

National General | $147 | $1,762 |

Monthly and annual costs of car insurance for 30-year-olds.

How the cost of car insurance for 30-year-olds compares to other ages

Car insurance for 30-year-olds is much cheaper than rates for younger drivers — especially drivers under 25. Thirty-year-olds pay about 67% less than teenage and young adult drivers.

On the other hand, 30-year-olds pay slightly more for car insurance than older drivers. Compared to drivers who are 35 to 70 years old, the cost of coverage for 30-year-olds is 11% more expensive.

But if you’re a 30-year-old who just got your license last year, you’ll have a harder time finding cheap car insurance.

A brand new driver doesn’t have the same experience behind the wheel as a 30-year-old who’s been driving since 16. Rates will go down with age and experience, though, as long as you avoid accidents and driving violations.

Best car insurance for 30-year-olds: GEICO

On average, GEICO costs 30-year-olds less than most other car insurance companies. While MAPFRE and USAA offer cheaper average rates than GEICO, its national availability makes it the best choice for most 30-year-olds looking for cheap coverage.

Thirty-year-olds can also get great customer service from GEICO. GEICO earned a high rating from us thanks in part to its great customer service scores from J. D. Power and low number of consumer complaints.

Company | Policygenius rating | Minimum coverage cost | Full coverage cost |

|---|---|---|---|

GEICO | 4.6 | $402 | $1,188 |

COUNTRY Financial | 4.3 | $526 | $1,488 |

Travelers | 4.3 | $683 | $1,564 |

American Family | 4.2 | $676 | $1,486 |

Amica | 4.2 | $811 | $1,735 |

Erie | 3.9 | $370 | $1,212 |

Farm Bureau | 4.2 | $483 | $1,513 |

Progressive | 4.1 | $737 | $1,836 |

Allstate | 4.0 | $750 | $2,005 |

USAA | 4.0 | $369 | $1,091 |

Auto-Owners Insurance | 3.9 | $327 | $1,208 |

Farmers | 3.9 | $781 | $1,997 |

MAPFRE | 3.9 | $335 | $1,066 |

National General | 3.9 | $627 | $1,762 |

NJ Manufacturers | 3.9 | $830 | $1,539 |

Nationwide | 3.8 | $624 | $1,520 |

State Farm | 3.8 | $475 | $1,194 |

The Hartford | 3.7 | $653 | $2,123 |

CSAA | 3.4 | $763 | $2,467 |

Mercury Insurance | 2.9 | $1,081 | $2,668 |

Companies ranked by Policygenius rating

Cheapest car insurance companies for 30-year-olds

GEICO is our pick for the cheapest overall company for most 30-year-olds. GEICO also has the best car insurance rates for 30-year-olds in 14 states, including the District of Columbia.

USAA is the cheapest insurance company for 30-year-olds in more states than GEICO. But remember that USAA only writes auto insurance coverage for active and retired service members and their families, so most drivers won’t qualify for coverage.

State | Cheapest car insurance company | Average monthly cost |

|---|---|---|

GEICO | $81 | |

USAA | $81 | |

Root | $62 | |

USAA | $84 | |

Wawanesa | $96 | |

American National | $71 | |

GEICO | $63 | |

State Farm | $97 | |

GEICO | $86 | |

GEICO | $127 | |

Auto-Owners | $71 | |

GEICO | $65 | |

American National | $44 | |

Pekin | $62 | |

USAA | $63 | |

State Farm | $61 | |

USAA | $80 | |

GEICO | $84 | |

USAA | $130 | |

GEICO | $48 | |

USAA | $70 | |

GEICO | $92 | |

GEICO | $88 | |

Farm Bureau | $81 | |

USAA | $76 | |

USAA | $66 | |

USAA | $76 | |

Auto-Owners | $89 | |

GEICO | $87 | |

USAA | $60 | |

GEICO | $92 | |

USAA | $79 | |

Progressive | $90 | |

GEICO | $60 | |

USAA | $71 | |

GEICO | $61 | |

USAA | $83 | |

State Farm | $71 | |

State Farm | $89 | |

State Farm | $83 | |

American National | $60 | |

Kemper | $96 | |

State Farm | $64 | |

Farm Bureau | $88 | |

GEICO | $69 | |

State Farm | $56 | |

USAA | $68 | |

USAA | $90 | |

USAA | $76 | |

USAA | $60 | |

American National | $67 |

Cheapest car insurance company in every state for a 30-year-old

Average car insurance costs for 30-year-old drivers by gender

Auto insurance rates for 30-year-old male drivers are more expensive than for female drivers of the same age — but not by much. Insurance costs 30-year-old men just $9 more per month, on average.

There are a few states where insurance companies can’t set rates based on gender. This means that in California, Hawaii, Massachusetts, Michigan, Montana, and Pennsylvania, rates for 30-year-olds aren’t based on gender at all.

Gender | Average monthly cost | Average annual cost |

|---|---|---|

Male driver | $165 | $1,983 |

Female driver | $156 | $1,875 |

Difference | $9 | $108 |

Cost of car insurance for 30-year-old drivers by credit score

Car insurance costs for 30-year-olds with poor credit will be much higher than average. We found that a 30-year-old with a poor credit score pays $1,687 more per year than someone with excellent credit.

If your credit score is less than excellent, working to improve it can help you save money on your car insurance. Going from a credit rating of 735 to 770 is a relatively small jump, but those few points could save you more than $300 a year on your car insurance premium.

Credit score | Credit score | Average monthly cost |

|---|---|---|

Excellent | 823+ | $118 |

Very Good | 795-822 | $131 |

Good | 769-794 | $143 |

Fair | 710-740 | $174 |

Poor | 524-577 | $259 |

Cost of full-coverage car insurance for a 30-year-old

→ Read about how your insurance cost is affected by your credit score

Average car insurance costs for 30-year-old drivers by state

The average cost of car insurance for 30-year-olds is $142 per month, but this varies depending on the state. Ohio is the cheapest state for car insurance for 30-year-olds, average rates are just $91 per month. At $250 per month, Louisiana is most expensive for 30-year-olds.

Even though you may live in a state where the cost of car insurance is high, you can still usually find cheap coverage for 30-year-olds by comparing car insurance quotes from different companies in your area. Comparing quotes before you buy will help you find your best rates and avoid overpaying.

State | Average monthly cost | Average annual cost |

|---|---|---|

Alabama | $149 | $1,789 |

Alaska | $116 | $1,386 |

Arizona | $135 | $1,621 |

Arkansas | $155 | $1,860 |

California | $161 | $1,932 |

Colorado | $150 | $1,803 |

Connecticut | $154 | $1,845 |

Delaware | $179 | $2,145 |

District of Columbia | $152 | $1,827 |

Florida | $250 | $3,004 |

Georgia | $146 | $1,752 |

Hawaii | $100 | $1,200 |

Idaho | $96 | $1,156 |

Illinois | $122 | $1,467 |

Indiana | $107 | $1,278 |

Iowa | $100 | $1,198 |

Kansas | $140 | $1,675 |

Kentucky | $188 | $2,253 |

Louisiana | $250 | $2,996 |

Maine | $100 | $1,200 |

Maryland | $156 | $1,873 |

Massachusetts | $140 | $1,681 |

Michigan | $203 | $2,438 |

Minnesota | $121 | $1,455 |

Mississippi | $147 | $1,758 |

Missouri | $137 | $1,643 |

Montana | $163 | $1,958 |

Nebraska | $151 | $1,811 |

Nevada | $184 | $2,203 |

New Hampshire | $106 | $1,267 |

New Jersey | $192 | $2,301 |

New Mexico | $127 | $1,518 |

New York | $183 | $2,201 |

North Carolina | $85 | $1,018 |

North Dakota | $120 | $1,438 |

Ohio | $91 | $1,088 |

Oklahoma | $168 | $2,010 |

Oregon | $126 | $1,510 |

Pennsylvania | $141 | $1,690 |

Rhode Island | $162 | $1,942 |

South Carolina | $162 | $1,941 |

South Dakota | $138 | $1,660 |

Tennessee | $115 | $1,385 |

Texas | $160 | $1,918 |

Utah | $130 | $1,555 |

Vermont | $96 | $1,156 |

Virginia | $117 | $1,401 |

Washington | $142 | $1,699 |

West Virginia | $144 | $1,723 |

Wisconsin | $92 | $1,102 |

Wyoming | $119 | $1,431 |

Average car insurance cost for 30-year-olds in every state

How to save money on car insurance for 30-year-old drivers

While car insurance for 30-year-olds is cheaper than it is for teens and other young drivers, it can still be expensive. If your insurance premiums are too high, here are some tips that can help lower your rates:

Compare quotes: Shopping around before you buya is the most reliable way to find the best company for you — and to avoid paying more than you have to for coverage.

Find discounts: Most car insurance companies offer discounts that can save you money. Bundling discounts, loyalty discounts, and discounts for taking a safety course can all help lower your rates.

Consider usage-based insurance: If you opt in to your company’s telematics or usage-based program, you can save money for safe driving habits — but you’ll have to agree to have your driving tracked for a few weeks.