How to buy car insurance

You can buy car insurance directly from an insurance company, by working with an agent, or by shopping online through a marketplace. The best and most efficient way to buy car insurance is through an online marketplace so you can compare quotes from multiple companies and find the most affordable rates in your area.

Continue reading for a step-by-step guide to buying auto insurance.

1. Pock where to shop for car insurance

There are a few different ways to buy a new car insurance policy. You can buy a policy directly from an insurance company by getting a quote online, you can work with an agent or broker, or you can use an online marketplace to compare multiple quotes at once.

Method | Pros | Cons |

|---|---|---|

Buy directly from an insurance company | Many companies make it simple to get quotes and buy coverage online | You’ll only see quotes from one company at a time, so you’ll have to compare costs yourself to find the cheapest rate |

Buy through an agent | Agents have physical offices in your area so you can buy insurance in in person | Some agents may charge additional fees or only show you quotes from certain companies |

Shop through an online marketplace | You’ll be able to compare quotes from multiple companies at once, without having to enter your information again and again | You won’t be able to visit an office in person, so this option is best for people who like shopping online or over the phone |

2. Figure out how much coverage you need

Figuring out how much coverage you need is one of the most important parts of buying auto insurance. In 2020 the medical costs from fatal motor vehicle accidents totaled more than $537 million. [1] You don't want to be on the hook for expensive medical bills or repairs after a at-fault accident.

Generally, it's a good idea for drivers to get as much liability coverage as they can afford. Adding comprehensive and collision coverage is a good idea, but the amount of insurance you should get depends on your car's value, too. A typical full-coverage policy includes:

Liability coverage: Covers the costs if you cause an accident, including when you damage someone else’s property with your car. Liability insurance is required in most states, and it’s divided into two parts: Bodily injury liability (BIL) and property damage liability (PDL)

Personal injury protection: Often called PIP or no-fault coverage, this covers medical and rehabilitation expenses if you or your passengers are injured in a car accident. Also covers other related expenses, like lost wages

Uninsured/underinsured motorist coverage: Covers the costs if you’re in an accident caused by a driver who either doesn’t have insurance or whose insurance can’t pay for the full extent of the damage

Collision coverage: Covers damage to your own vehicle after an accident, regardless of who was at fault

Comprehensive coverage: Covers any damage to your car that can happen when it isn’t being driven, including damage from extreme weather, falling objects, flood, fire, vandalism, and theft

Gap insurance: If your car is totaled, this pays out the difference between the car’s actual cash value (ACV), which includes depreciation, and the amount you still owe on a car loan or lease so you aren’t stuck making payments on a car you no longer have

Most insurers offer additional coverage options, like roadside assistance or new car replacement coverage that you can add to your policy (just remember that more coverage means higher rates).

Each state has minimum car insurance coverage requirements. Your state’s minimums are a starting point for determining coverage, but they’re too low to sufficiently cover you in the event of a major accident.

3. Fill out an application

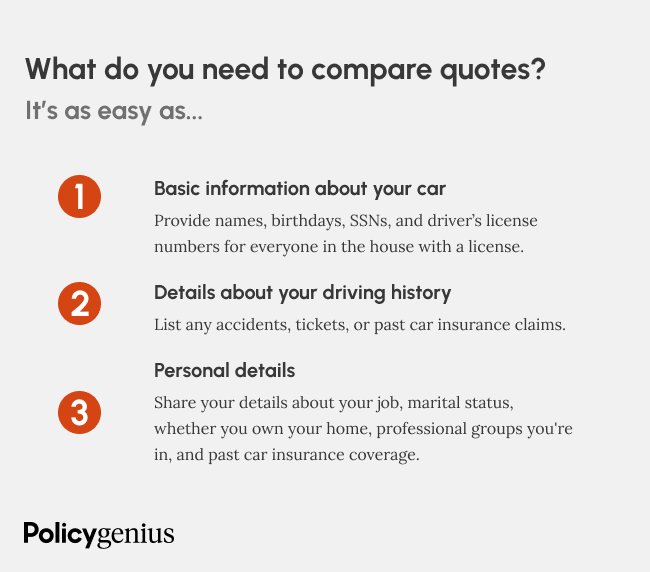

Whether you’re buying car insurance for the very first time, adding a car, or renewing your coverage with the same insurer, you’ll need the following information on hand:

Names, birthdays and driver’s license numbers for all drivers in the household

Social Security numbers for all drivers in the household

VINs (Vehicle Information Numbers) or make and model years for all vehicles

An address for the insured (where you live and where the car is garaged, which is usually the same place)

Your declarations page from your most recent prior car insurance policy, if you have it

As you go through the application process, your answers to certain questions may earn you discounts on your coverage, like whether you have any accidents or violations on your record, whether you’re a full time student, and if your car is equipped with features like an anti-theft device or GPS tracker (though you may want to find an anonymous car insurance quote, you'll need to share personal information if you want an accurate quote).

You’ll also set your coverage amounts — called limits — when you apply for insurance. It’s generally a good idea to have higher coverage limits, even though adding more coverage will affect how much you pay for car insurance. You’ll also have to choose deductible amounts for your comprehensive and collision coverage.

When you get a quote online or use a car insurance calculator, some optional types of coverage may automatically be included that you don’t actually want or need. For example, if you're a member of AAA and you already have roadside assistance, you don't need to pay extra to add it to your car insurance policy. And no need to worry; you don't have to make a minimum deposit when buying a car insurance policy, though you will be expected to make your first payment up front.

As you shop for insurance, be sure to look carefully at whether there are any add-ons you can remove.

4. Compare auto insurance quotes

It's a good idea to get quotes from a few different insurance companies before you choose a policy. You should also have an idea of how much you can afford to pay for coverage before you start shopping.

You should look for the insurance company that offers you the most protection and the best customer service at the lowest rates. Also, consider your needs carefully when choosing a policy. For instance, families may need different insurance than single adults.

Not sure which company to go with? Use our compare car insurance page or our list of the best car insurance companies to learn more about your options before you pick a policy.

➞ Learn more about how long it takes to get car insurance

5. Choose a policy and get insured

Once you’ve compared your quotes and picked an insurance company that you feel good about, it’s time to get covered.

When you buy a car insurance policy, you’ll set a start date for when your policy will start, and you’ll pay your first premium.

You’ll typically receive proof of coverage and some sort of welcome package from your insurer, with information about how to access your account and where to see your ID cards or declarations page. If you're bundling your renters insurance or homeowners insurance with your car insurance policy, you'll receive multiple declarations pages.

6. Cancel your old car insurance policy

If you’ve been shopping for car insurance to replace a current policy, wait until after your new coverage is in place before you cancel your old policy. You want to make sure you don’t leave any gaps in your coverage.

To do this, set the cancellation date of your old policy and the effective date of your new policy on the same day. Insurance policies begin and end at 12:01 AM on a given date, so you don’t have to worry about having a full day of overlapping insurance — though you won't be penalized if the two policies overlap for a short time.

➞ Learn more about how to switch car insurance

4 things to know before buying auto insurance

Before you start shopping, make sure you understand exactly what you need from a car insurance policy. Here are four things to consider before you buy car insurance, whether you're getting it for the first time or considering switching policies.

Understand how much coverage you need: If you have a loan or lease, you may be required to have full-coverage car insurance — a policy that includes comprehensive and collision coverage. Full-coverage is good to have even if it’s not required, so you know your policy covers damage to your own car too.y

Know how much car insurance will cost: While it's hard to predict exactly what you'll pay for car insurance without getting a quote, you can check out average car insurance rates for drivers like you to get an idea of what you’ll pay. Expect to pay higher rates if you’re under 25, have poor credit, or have a recent accident or claim on your record.

Check out ways to pay: Make sure you know whether the companies you’re looking at offer six-month or 12-month policy terms (or both), and understand the payment options. Some companies even offer discounts for setting up automatic electronic payments or for paying the whole policy in full.

Know how to file a claim: Do some research into the car insurance claims process at each company you’re considering. Decide if you’re willing to pay more for a company with high claims-satisfaction ratings, or whether it’s important to you that the company you choose offers online or mobile claims filing.

What to look for when shopping for car insurance

It's easy to compare quotes from top auto insurance companies when you use an online marketplace like Policygenius, but once you've got the quotes in front of you, how do you know which company to choose? Here's what to look for when you're buying car insurance:

Cost: See which company offers you the most competitive rates, and take a little extra time to research average car insurance rates for your age, location, and driving history to make sure you're not paying more than you should.

Reviews: Know a little bit about the company before you finalize your policy. You can start with our list of best car insurance companies to learn more about customer service and claims satisfaction ratings.

Discounts: Car insurance discounts should be automatically applied to your policy, but it's never a bad idea to check with a representative from your insurance company to make sure you're getting the discounts you deserve.

How to choose a trustworthy car insurance company

The best place to start when considering whether or not a car insurance company will be reliable is with trusted reviews. Check out our Policygenius list of the best car insurance companies for different types of drivers, which also consider third-party rankings, like financial stability scores from AM Best and customer satisfaction ratings from J.D. Power.

Remember that individual experiences aren't always the best way to judge whether or not a car insurance company is reliable — just because one driver may have a bad experience or a great one doesn't mean you'll have the same results.

Buying car insurance locally

Where you live is one of the biggest factors in what you'll pay for car insurance, and average auto insurance rates can vary widely from state to state.

Drivers who live in big cities or areas with lots of traffic will pay more for car insurance than people who live in sleepy towns with fewer cars on the road. There are also local auto insurance companies to consider — sometimes the company with the most competitive rates for you will be a smaller, regional company and not a big auto insurance carrier.

Choose your state from the dropdown below to find out about the best companies and average auto insurance costs in your area.

Common car insurance terms to know

When you're buying car insurance, you may encounter some unfamiliar words and phrases. Here's some basic language to know when you're shopping for auto insurance.

Accident forgiveness: A policy perk that means you won't have your rates raised after an accident.

Actual cash value (ACV): The value of your car when adjusted for depreciation and wear-and-tear.

Claims adjuster: The person who helps determine how much you're owed after a car insurance claim.

At-fault party: Whoever is deemed financially responsible after a car accident.

Carrier: Another word for a car insurance company.

Declarations page: The front page of your car insurance policy, this usually lists all the important information, like who is on the policy and what coverage it includes.

Deductible: The amount that you pay out of pocket towards a claim when you use certain kinds of car insurance coverage, like comprehensive or collision coverage.

Depreciation: The gradual loss of value that vehicles experience over time.

Insurable interest: The reason you need a car insurance policy (usually this just means that you own a car).

Lienholder: The bank or other institution that lends the money for a financed car.

Motor vehicle report (MVR): A summary of your driving record, including any recent accidents, tickets, or violations.

No-fault state: States that require every driver to have PIP coverage and pay for their own injuries after a car accident.

Policyholder: The person covered by a car insurance policy.

Policy limits: The maximum amount that each type of coverage in your car insurance policy will pay out in the event of a covered incident.

Roadside assistance: A coverage add-on that pays for emergency services like towing, tire changes, or fuel delivery.