How much is car insurance?

Car insurance costs an average of $136 per month for a full-coverage policy and $51 per month for minimum coverage. That means that the average driver pays $1,638 a year for full coverage and $617 a year for minimum coverage.

But that's just an overall average — what you’ll actually pay for auto insurance is based on personal details like your age, driving history, and ZIP code.

We calculated how much car insurance costs using rates from across the U.S. Our analysis takes into account the range of factors that can affect your policy, so you can understand how much auto insurance really costs — and compare car insurance rates based on your needs.

If you're looking for new car insurance because your rates have gone up, you're not alone. Auto insurance costs have been on the rise thanks to factors like inflation and supply-chain disruptions, and that trend has continued in 2023. Knowing the average car insurance rates for your profile can help you be sure you're finding the best price.

Are car insurance prices going up? What you need to know

Drivers across the country may notice serious rate increases when it’s time to renew their car insurance policies — even if they didn't file a claim or change anything about their coverage.

A 2023 Policygenius survey conducted in April found that 43% of U.S. drivers reported paying more for car insurance than at the same time the previous year.

Most drivers didn't see car insurance rate increases during the first years of the COVID-19 pandemic, and some companies even offered car insurance refunds since so many drivers were staying home.

But with American drivers back to work and a recent period of high inflation, companies are working overtime to catch up, and rate increases may hit some states harder than others. "In some states like North Carolina, insurance companies are looking to increase auto rates by as much as 25% this year," Siebold said.

If your rates have recently gone up, take some time to check with your car insurance company that they have the right information about your mileage and vehicle usage, and see if there are any other available discounts. But a rate hike may also mean it’s a good time to shop around for new car insurance.

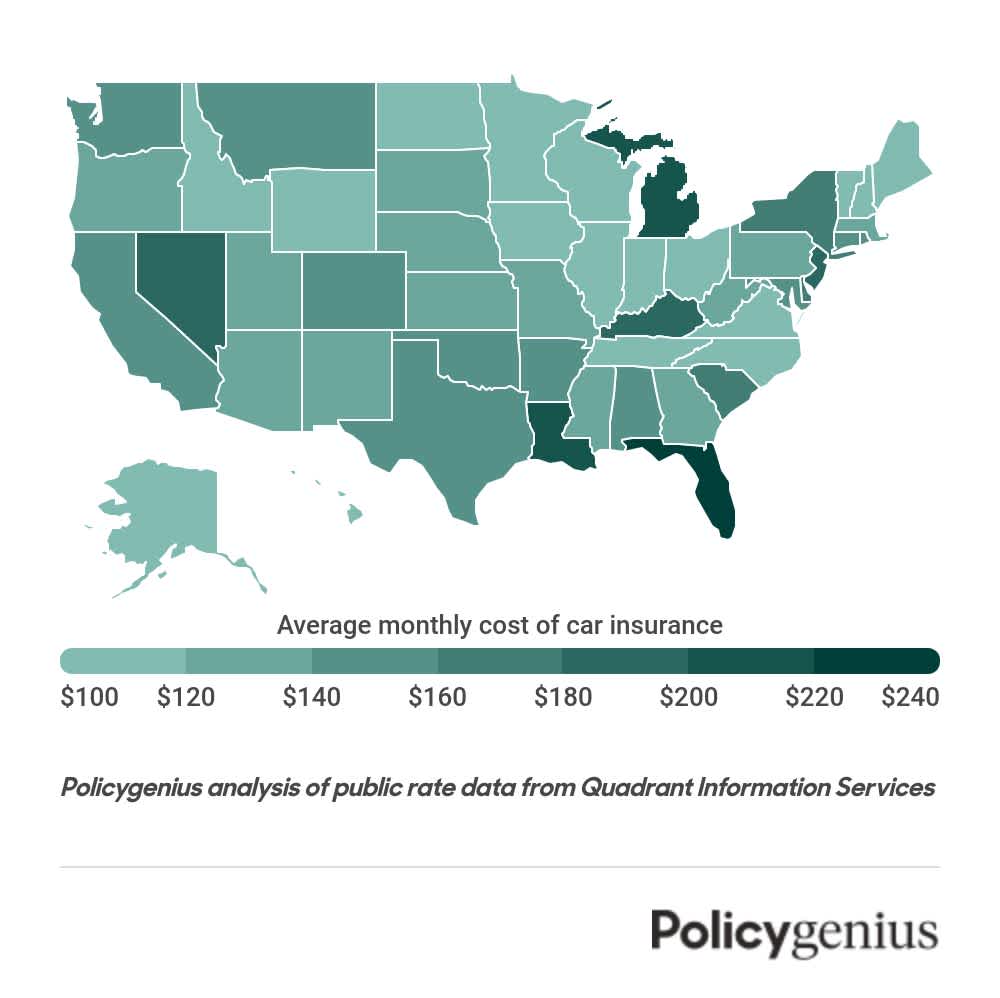

How much car insurance costs in each state

Where you live, including your state, city, and even your ZIP code are some of the most important factors that determine your car insurance rates.

The average cost of car insurance is $1,638 per year, but we found that the cost of car insurance in the most and least expensive states is separated by $1,786 per year.

Car insurance costs by state

There are a few reasons why the cost of car insurance varies so much based on your location. If your area is more densely populated, has higher crime rates, lots of uninsured drivers, or frequent natural disasters, that means more claims — and higher rates.

Average cost per month | Average cost per year | |

|---|---|---|

$144 | $1,728 | |

$116 | $1,393 | |

$133 | $1,600 | |

$147 | $1,768 | |

$153 | $1,837 | |

$154 | $1,852 | |

$155 | $1,856 | |

$179 | $2,144 | |

$150 | $1,802 | |

$233 | $2,794 | |

$135 | $1,625 | |

$101 | $1,208 | |

$91 | $1,094 | |

$111 | $1,332 | |

$101 | $1,215 | |

$97 | $1,158 | |

$128 | $1,532 | |

$182 | $2,181 | |

$211 | $2,531 | |

$91 | $1,096 | |

$149 | $1,784 | |

$129 | $1,553 | |

$202 | $2,425 | |

$118 | $1,422 | |

$139 | $1,664 | |

$132 | $1,588 | |

$158 | $1,902 | |

$135 | $1,617 | |

$183 | $2,198 | |

$107 | $1,284 | |

$185 | $2,225 | |

$122 | $1,460 | |

$171 | $2,048 | |

$90 | $1,084 | |

$117 | $1,405 | |

$84 | $1,008 | |

$143 | $1,713 | |

$120 | $1,443 | |

$139 | $1,672 | |

$153 | $1,830 | |

$168 | $2,018 | |

$124 | $1,487 | |

$111 | $1,329 | |

$152 | $1,818 | |

$130 | $1,555 | |

$87 | $1,047 | |

$112 | $1,349 | |

$144 | $1,730 | |

$135 | $1,615 | |

$92 | $1,109 | |

$116 | $1,394 |

Average rates for male and female drivers ages 30, 35, and 45. Rates provided by Quadrant Information Services. Rates provided are a sample of costs. Your actual quotes may differ.

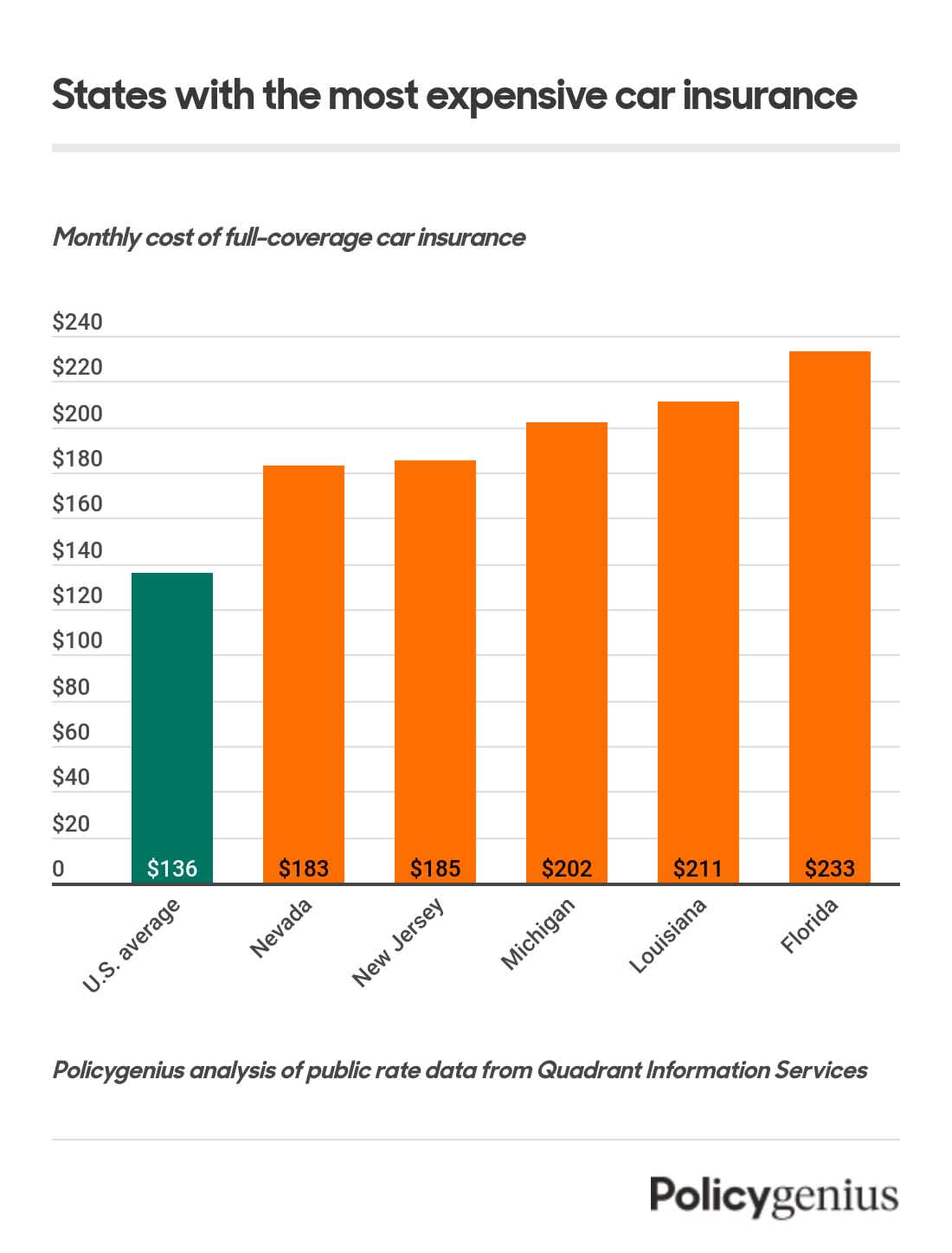

The most expensive states for car insurance

On average, auto insurance is most expensive in Florida, where rates are 71% more expensive than for most drivers nationwide. We found that the cost of car insurance in Florida is $96 more expensive per month, or $1,156 per year, compared to the national average.

Louisiana, Michigan, New Jersey, and Nevada are also among the most expensive states for car insurance.

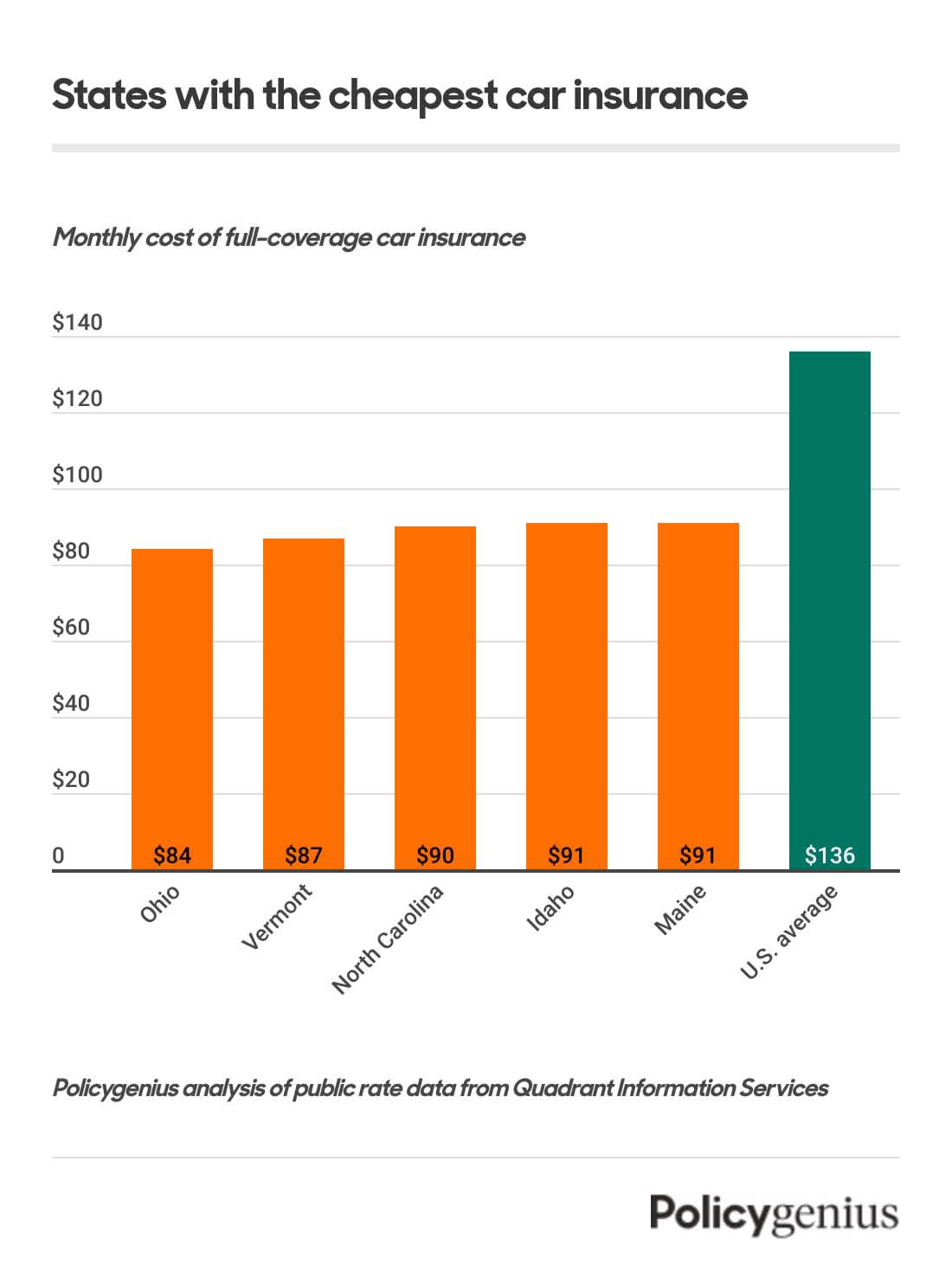

The cheapest states for car insurance

Ohio is the cheapest state for car insurance. The average cost of a full-coverage policy in Ohio is $84 per month (or $1,008 per year), which is $630 cheaper than the national average.

Car insurance costs are also low in Vermont, North Carolina, Idaho, and Maine, according to our analysis.

States that have the lowest insurance costs sometimes have lower minimum coverage requirements, making it tempting to opt out of certain types of coverage. But this is a bad way to save money, since going without enough insurance can leave you on the hook for after an accident.

How much does car insurance cost by city?

The cost of car insurance also varies by city, even within the same state. Average rates in one city can be hundreds or even thousands of dollars more expensive than another city in the same state, so you should be sure to compare quotes and estimate your costs before buying coverage.

The city with the most expensive car insurance prices is Detroit, where coverage costs $467 per month, or $5,609 per year — that’s $3,971 more each year than the national average rate. New York City, Miami, Philadelphia follow Detroit as the most expensive cities for car insurance.

Average cost per month | Average cost per year | |

|---|---|---|

$467 | $5,609 | |

$378 | $4,534 | |

$335 | $4,015 | |

$258 | $3,096 | |

$241 | $2,888 | |

$225 | $2,706 | |

$224 | $2,690 | |

$218 | $2,613 | |

$207 | $2,483 | |

$194 | $2,324 | |

$186 | $2,231 | |

$183 | $2,198 | |

$182 | $2,182 | |

$181 | $2,173 | |

$181 | $2,170 | |

$180 | $2,161 | |

$176 | $2,109 | |

$170 | $2,045 | |

$164 | $1,966 | |

$163 | $1,956 | |

$162 | $1,950 | |

$161 | $1,938 | |

$157 | $1,889 | |

$157 | $1,888 | |

$156 | $1,877 | |

$153 | $1,836 | |

$151 | $1,808 | |

Washington, DC | $150 | $1,802 |

$149 | $1,790 | |

$146 | $1,754 | |

$142 | $1,700 | |

$125 | $1,503 | |

$114 | $1,370 | |

$110 | $1,320 | |

$106 | $1,274 | |

$99 | $1,191 | |

$96 | $1,153 |

Cities sorted from most to least expensive.

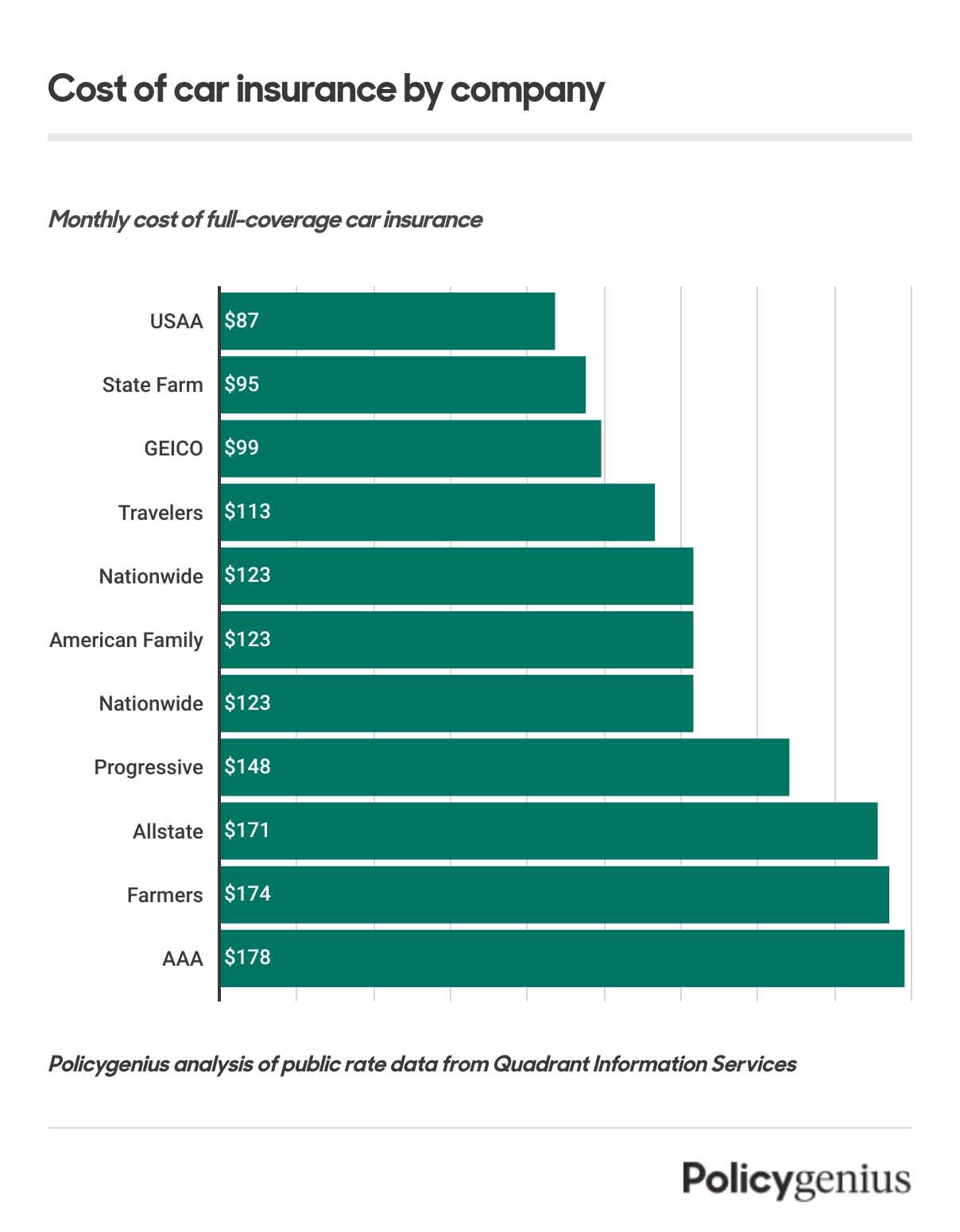

How much does car insurance cost by company?

Car insurance can cost thousands of dollars more per year at one insurance company compared to another. Our analysis found that the average cost of auto insurance can vary by as much as $91 per month (or $1,090 per year) across the largest companies.

While many top auto insurance companies use the same factors to set your rate — including your location, age, and driving history — not every provider evaluates these factors the same way.

In our analysis, USAA has the best car insurance rates among the largest providers. But since USAA is only an option for people in the military, GEICO more often has the most affordable insurance rates for most people.

Smaller insurers, like Auto-Owners Insurance, or even local companies, may have cheap rates, too.

Average cost per month | Average cost per six month | Average cost per year | |

|---|---|---|---|

$87 | $520 | $1,040 | |

$87 | $522 | $1,044 | |

$95 | $571 | $1,141 | |

$97 | $583 | $1,165 | |

$98 | $591 | $1,181 | |

$99 | $596 | $1,192 | |

$105 | $631 | $1,262 | |

$113 | $676 | $1,351 | |

$118 | $708 | $1,416 | |

$123 | $738 | $1,475 | |

$123 | $739 | $1,479 | |

Farm Bureau | $129 | $774 | $1,547 |

$131 | $787 | $1,574 | |

Shelter | $147 | $882 | $1,764 |

$148 | $890 | $1,780 | |

Kemper | $149 | $891 | $1,783 |

Auto Club Michigan | $169 | $1,014 | $2,029 |

$171 | $1,027 | $2,055 | |

$174 | $1,042 | $2,084 | |

$178 | $1,067 | $2,134 | |

Hartford | $193 | $1,160 | $2,319 |

CSAA | $202 | $1,213 | $2,426 |

$215 | $1,289 | $2,577 | |

Sentry | $262 | $1,570 | $3,139 |

The Hanover | $340 | $2,037 | $4,075 |

Car insurance companies with at least $1 billion in written premiums, ordered from cheapest to most expensive.

Average cost of car insurance by coverage type and amount

Your car insurance rates also depend on how much insurance you get. A full-coverage policy (which includes comprehensive and collision coverage in addition to liability) can raise your premiums by hundreds of dollars a year.

Average cost per month | Average cost per year | |

|---|---|---|

Liability | $54 | $644 |

Collision | $32 | $378 |

Comprehensive | $14 | $168 |

Car insurance rates also depend on what other extras or endorsements you add to your policy — extra coverage options like gap insurance and roadside assistance can mean more protection, but also higher costs.

On average, car insurance rates initially increase by 174% when you choose a full-coverage policy over minimum coverage, but your premiums only go up by 6% when you double your liability coverage.

Minimum coverage | Full coverage (50/100) | More coverage (100/300) | |

|---|---|---|---|

Alabama | $51 | $144 | $167 |

Alaska | $36 | $116 | $127 |

Arizona | $53 | $133 | $149 |

Arkansas | $44 | $147 | $166 |

California | $50 | $153 | $170 |

Colorado | $45 | $154 | $176 |

Connecticut | $79 | $155 | $165 |

Delaware | $82 | $179 | $189 |

District of Columbia | $57 | $150 | $161 |

Florida | $104 | $233 | $264 |

Georgia | $68 | $135 | $157 |

Hawaii | $35 | $101 | $106 |

Idaho | $33 | $91 | $104 |

Illinois | $47 | $111 | $129 |

Indiana | $38 | $101 | $112 |

Iowa | $26 | $97 | $106 |

Kansas | $41 | $128 | $147 |

Kentucky | $78 | $182 | $203 |

Louisiana | $83 | $211 | $283 |

Maine | $37 | $91 | $107 |

Maryland | $75 | $149 | $166 |

Massachusetts | $51 | $129 | $147 |

Michigan | $74 | $202 | $210 |

Minnesota | $46 | $118 | $124 |

Mississippi | $45 | $139 | $160 |

Missouri | $47 | $132 | $146 |

Montana | $41 | $158 | $172 |

Nebraska | $35 | $135 | $158 |

Nevada | $80 | $183 | $203 |

New Hampshire | $39 | $107 | $108 |

New Jersey | $96 | $185 | $205 |

New Mexico | $38 | $122 | $139 |

New York | $81 | $171 | $191 |

North Carolina | $35 | $90 | $90 |

North Dakota | $34 | $117 | $124 |

Ohio | $32 | $84 | $95 |

Oklahoma | $41 | $143 | $163 |

Oregon | $64 | $120 | $132 |

Pennsylvania | $42 | $139 | $149 |

Rhode Island | $72 | $153 | $175 |

South Carolina | $65 | $168 | $178 |

South Dakota | $28 | $124 | $143 |

Tennessee | $38 | $111 | $126 |

Texas | $54 | $152 | $168 |

Utah | $56 | $130 | $140 |

Vermont | $32 | $87 | $106 |

Virginia | $48 | $112 | $123 |

Washington | $52 | $144 | $156 |

West Virginia | $52 | $135 | $157 |

Wisconsin | $29 | $92 | $97 |

Wyoming | $27 | $116 | $125 |

Monthly car insurance rates based on different coverage amounts of bodily injury liability coverage. Minimum coverage includes enough insurance to meet the state's legal requirements, while the "full" and "most" columns are for $50,000 per person/$100,000 per accident and $100,000 per person/$300,000 per accident in bodily injury liability coverage.

Full coverage vs minimum coverage car insurance costs

On average, a full-coverage car insurance policy costs about $1,000 more per year than a minimum-coverage policy. Full coverage is more expensive because it includes more protection, specifically comprehensive and collision coverage, which pay for damage to your own car after an accident or another kind of incident.

This is why you shouldn’t get minimum-coverage car insurance just to avoid paying higher premiums. Even though it’s cheaper, minimum coverage can also leave you unprotected after an accident.

If you only get minimum coverage, you won’t have insurance to cover certain types of damage that would have been covered by comprehensive or collision — like damage from a falling tree branch, an at-fault accident, or reimbursement if your car is stolen.

→ Read more about the differences between minimum and full coverage

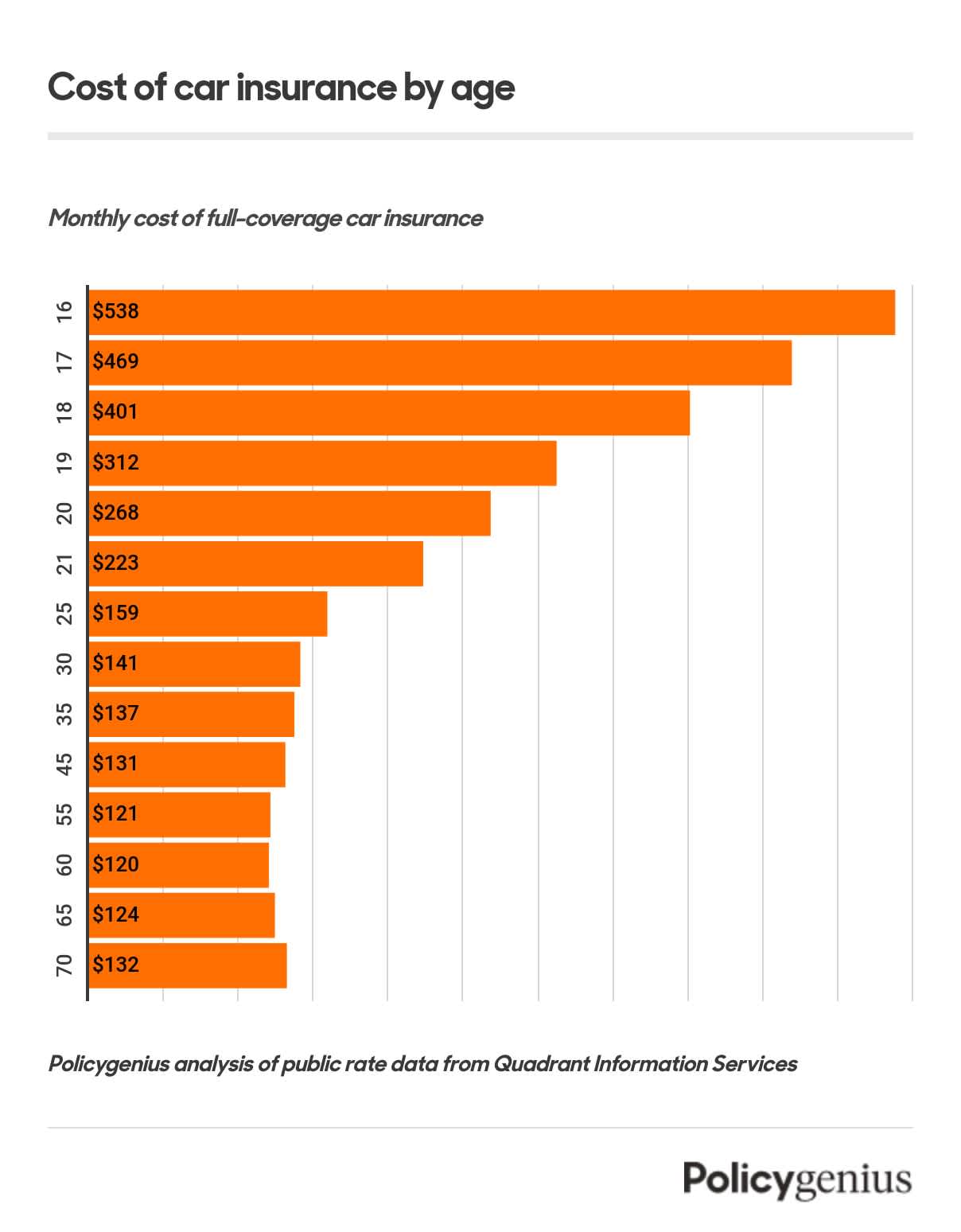

How much does car insurance cost by age?

Along with your location and the amount of insurance you have, age is one of the most important factors when it comes to auto insurance rates. Drivers under 25 tend to pay much more for coverage because of their inexperience behind the wheel.

The average cost of car insurance before you turn 25 can be thousands of dollars more expensive per year than for older drivers. For example, car insurance costs a newly licensed 16-year-old $378 more per month ($4,541 per year) than someone who’s 25.

Gen Zers have the most expensive costs of car insurance of any age group. Rates are $203 more expensive each month than average for these drivers and $200 more expensive than for the next youngest generation, millennials, and $213 higher than rates for Gen X.

Average cost per month | Average cost per year | |

|---|---|---|

Gen Z | $339 | $4,063 |

Millenials | $139 | $1,666 |

Gen X | $126 | $1,509 |

Baby boomers | $125 | $1,501 |

→ Read more about getting cheap coverage as a young driver

How much does car insurance cost by gender?

Gender can also have a small effect on your car insurance rates. On average, male drivers pay just $10 more per month than female drivers for coverage (but effectively the same amount each month). And after age 25, the price is nearly equal for male and female drivers.

Average cost per month | Average cost per year | |

|---|---|---|

Male | $136 | $1,638 |

Female | $136 | $1,628 |

A handful of states prohibit insurers from setting rates according to gender, including:

California

Hawaii

Massachusetts

Michigan

North Carolina

Pennsylvania

→ Read more about how your gender can affect your average car insurance cost

How much does car insurance cost by marital status?

Your car insurance costs can be affected by whether you’re married, divorced, or single. We found that the cost of auto insurance is lowest for married drivers. If you’re married, your rates cost $5 less than average per month.

Being single or divorced means that your insurance costs will be more expensive. Car insurance costs drivers who are single $6 more per month than average, while rates are about $5 more expensive than average for single drivers.

Average cost per month | Average cost per year | |

|---|---|---|

Divorced | $144 | $1,723 |

Married | $133 | $1,591 |

Single | $143 | $1,721 |

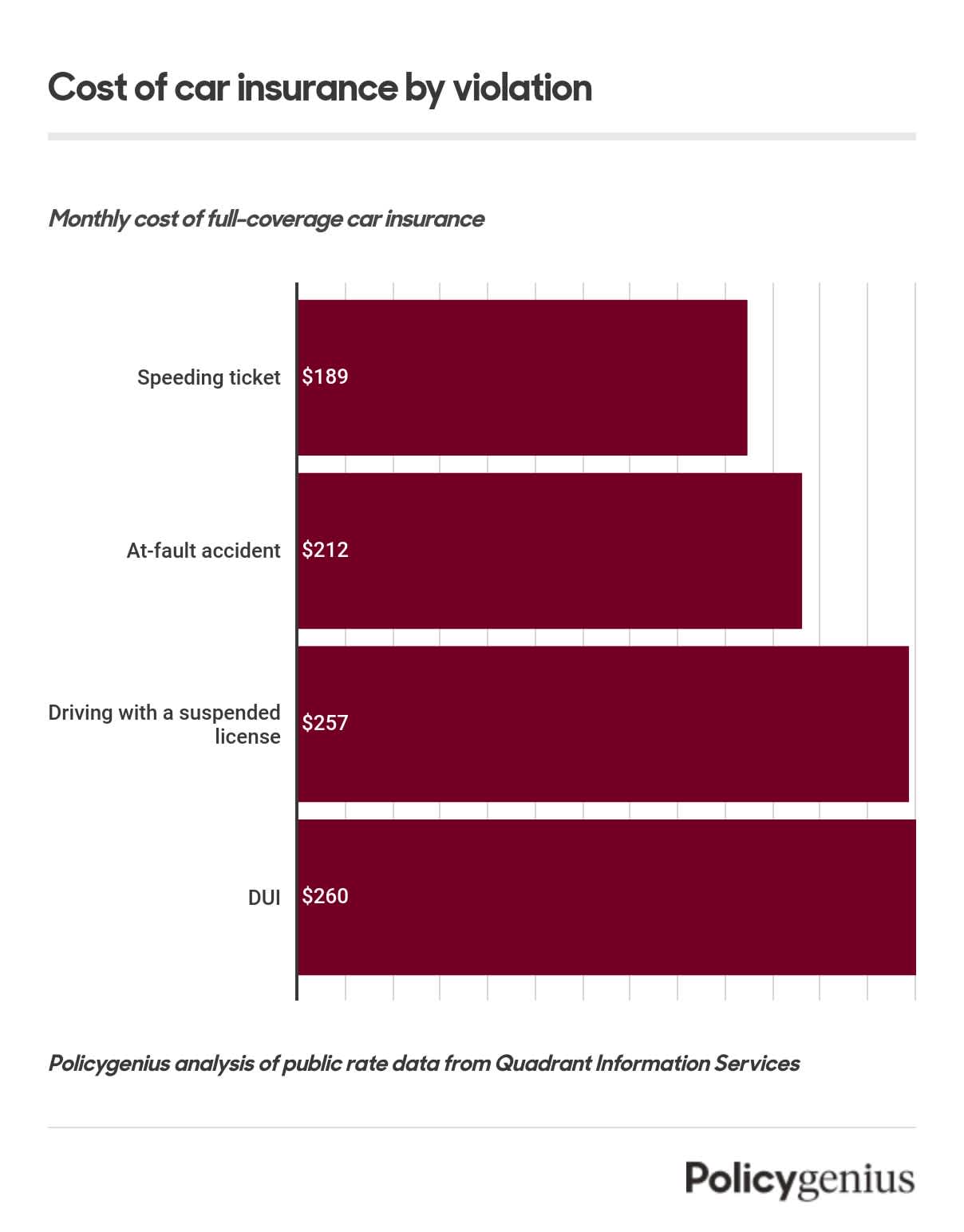

Average cost of car insurance after a driving violation

Your average car insurance costs will almost certainly get more expensive after a driving violation, like an accident or ticket. On average, a violation increases auto insurance rates by $69 per month, or $822 each year.

The average cost of car insurance changes differently depending on the violation. More serious violations usually lead to higher rate increases. For example, car insurance prices after a hit-and-run are $78 per month more expensive than for a driver cited for speeding.

Average cost per month | Average cost per year | Increase vs. average | |

|---|---|---|---|

At-fault accident | $213 | $2,555 | 55% |

Driving with a suspended license | $260 | $3,117 | 89% |

Driving with an open container | $207 | $2,485 | 50% |

Driving with expired registration | $172 | $2,068 | 25% |

DUI | $263 | $3,153 | 91% |

Failure to stop at a red light | $177 | $2,122 | 28% |

Hit and run | $265 | $3,182 | 93% |

Illegal turn | $177 | $2,123 | 29% |

Improper passing | $179 | $2,152 | 30% |

Not-at-fault accident | $149 | $1,784 | 8% |

Reckless driving | $251 | $3,013 | 82% |

Speeding ticket | $190 | $2,277 | 38% |

Table sorted alphabetically by violation.

→ Find the best companies for drivers with spotty records

Average cost of car insurance by credit score

How much your car insurance is depends in part on credit score. Having poor credit can increase your insurance rates by as much — or more — than some serious driving violations.

The average cost of car insurance for drivers with poor credit is $260 per month. That’s $123 more expensive than the national monthly average.

On the other hand, your car insurance rates go down as your credit score improves. We found that for drivers with an excellent credit rating auto insurance costs $25 less each month than someone with a good rating.

Credit score | Credit range | Average cost per month | Average cost per year |

|---|---|---|---|

Excellent | 800-850 | $117 | $1,400 |

Very Good | 740-799 | $129 | $1,550 |

Good | 670-739 | $142 | $1,703 |

Fair | 580-669 | $173 | $2,073 |

Poor | 300-579 | $260 | $3,117 |

In some states, car insurance companies aren’t allowed to use your credit score to calculate your rates, so if you live in California, Hawaii, Maryland, Massachusetts, Michigan, Oregon, Utah, or Washington your credit score won’t matter when it comes to car insurance.

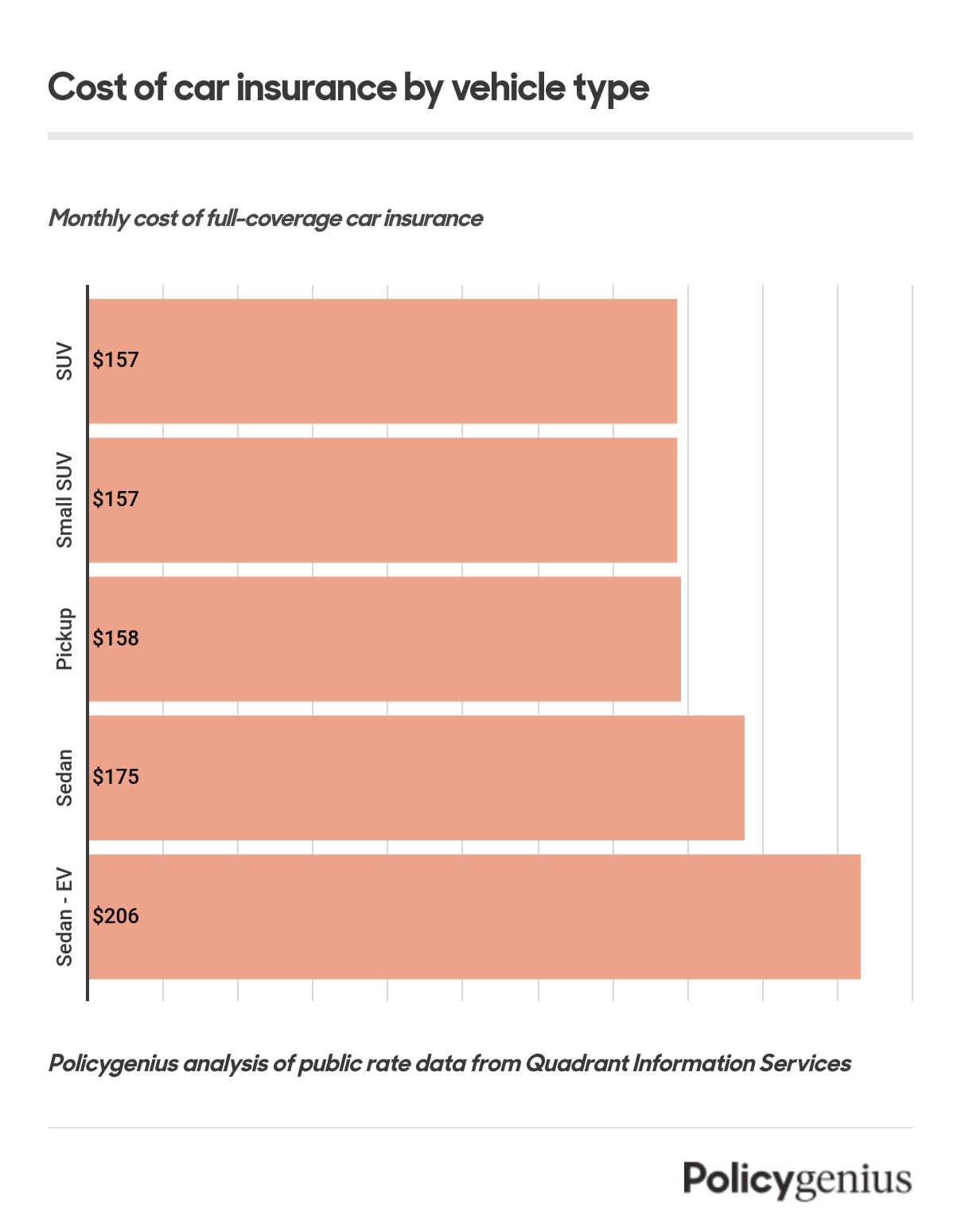

Average cost of car insurance by vehicle

We found that the cost of car insurance can change by hundreds of dollars a year depending on the car that you drive. Our analysis shows that electric cars cost $49 more each month than an SUV does. In fact, the costs to insure a small and regular-sized SUV are nearly the same.

The cost of car insurance for electric vehicles is $68 more than average per year, making these EVs the most expensive vehicles to insure.

The average cost of car insurance for SUVs is the cheapest, but we found that the Ford F-150 (a truck) is the most affordable vehicle to insure. Auto insurance rates for Teslas tend to be much more expensive. Insurance for a Tesla Model 3 and Y costs $1,000 more per year than for a Ford truck.

Average cost per month | Average cost per year | |

|---|---|---|

Ford F-150 | $146 | $1,753 |

Honda CR-V | $148 | $1,779 |

GMC Sierra | $151 | $1,808 |

Toyota Tacoma | $152 | $1,821 |

Subaru Outback | $152 | $1,822 |

Chevrolet Equinox | $153 | $1,841 |

Ford Escape | $155 | $1,859 |

Jeep Wrangler | $156 | $1,871 |

Toyota Highlander | $157 | $1,885 |

Jeep Grand Cherokee | $160 | $1,914 |

Ford Explorer | $160 | $1,923 |

Subaru Forester | $161 | $1,932 |

Nissan Rogue | $162 | $1,939 |

Chevrolet Silverado | $164 | $1,964 |

Toyota RAV4 | $167 | $2,005 |

Nissan Leaf | $170 | $2,040 |

Honda Civic | $174 | $2,084 |

Chevrolet Bolt EV | $174 | $2,085 |

Toyota Camry | $174 | $2,088 |

Toyota Corolla | $174 | $2,090 |

Ram 1500 | $176 | $2,106 |

Honda Accord | $177 | $2,121 |

Tesla Model 3 | $231 | $2,771 |

Tesla Model Y | $248 | $2,974 |

How the cost of car insurance changes over time

Car insurance tends to get more expensive each year — even for good drivers. From 2012 to 2021, the only year when costs fell was in 2020, when COVID unexpectedly changed the insurance industry.

Even by the first half of 2022, you can see that the cost of car insurance coverage had already increased by 4.6% compared to the previous year. [1]

H1 change | H2 change | Annual change | |

|---|---|---|---|

2012 | 3.0% | 4.2% | 3.6% |

2013 | 4.6% | 3.9% | 4.2% |

2014 | 4.1% | 4.4% | 4.2% |

2015 | 5.4% | 5.4% | 5.4% |

2016 | 5.8% | 6.6% | 6.2% |

2017 | 7.4% | 8.0% | 7.7% |

2018 | 8.7% | 6.2% | 7.4% |

2019 | 1.7% | 0.2% | 0.9% |

2020 | -4.9% | -4.4% | -4.6% |

2021 | 3.7% | 3.9% | 3.8% |

2022 | 4.6% | -- | -- |

More from Policygenius about car insurance costs

If you want to learn more about what drives the cost of car insurance, you can check out more of the news and research we’ve done about average costs, rate changes, and factors that cause drivers to pay more for insurance coverage.

What else affects car insurance prices?

There are even more factors that can affect your car insurance rates besides location, coverage levels, age, gender, marital status, car type, driving history, and credit score. The cost of car insurance can also be influenced by:

The company you choose: Even if you live in a state where rates are higher than average, some companies offer more competitive rates than others, which is why it’s important to shop around.

Discounts: Some of the most common car insurance discounts include savings for bundling policies, completing a driving safety course, and paying your annual policy in full.

Insurance history: You may pay more for car insurance if you've had past coverage with a high-risk provider or if you have a lapse in coverage on your record. If you have a history of consistent coverage and on-time payments, on the other hand, you could see lower rates.

Your annual mileage: If you use your car often, your auto insurance will cost more than for someone who drives infrequently.

Your job and education: In some states it's illegal for insurers to use your occupation and education to set rates. However, in many places you could pay more for car insurance if you're unemployed or if you didn't graduate from college

How to save money on car insurance

From the moment you start shopping around for auto insurance, there are a number of ways you can save. Even if you already have an existing car insurance policy, there are still some steps you can take to lower your premiums.